Aug 1, 2019 | Money Professor

Joint Accounts, Separate Accounts, Secret Accounts, No Accounts

I hope you find yourself somewhere in these stories. Apparently (at least in the US), more people- over 35%- are likely to divorce over financial issues than say infidelity.

So sad!

I hate to even write about this because a lot of my friends are newly married or dating wonderful people whom I believe will make amazing spouses. But, I also know from talking to a lot of people and my own experiences that money issues cannot be ignored. The sooner we address them, the better equipped we will be to find solutions when we find ourselves in a bind. So – journey with me.

Chipo’s evolving money story

Before I got married, I was a big fan of separate finances. I believed that women always get shortchanged in marriages. I grew up in a very patriarchal society where story after story was about cheating husbands, women who are left to start over from scratch after divorce, women who lose all their property after the death of a spouse, women who have to beg for household funds (including their salaries!).

I have also always felt that my mom like many women her generation brave enough to leave marriages that were not working for them gave up a lot financially and was forced to start over -including having to rent-Yikes! The death of my stepfather also exposed me to another form of cruelty that widows face. Beyond my story, I have also known friends who suffered financially because their mothers did not have personal wealth. I am forever grateful that my mom always worked hard to rebuild herself – but surely, it must get exhausting. Always starting over. So I was sure that I would not want to join anything.

My husband (the handsome, sweet, caring person) was the opposite. Early in our dating days, he took me to the atm to show me his bank balance. This was back when Zimbabwe still had working ATMs. He grew up in a home where my parents in love (we are cheezy) shared everything. Dad brought the paycheck, and mom managed it. They are still very much like that- I love them. They sang at our wedding – how cute is that. They rehearsed for months- oh my! So many heart emojis.

Because God is a comedian, he threw us into a tough space early on. Initially, we took it for granted that after my Ph.D. I would move back home. Unfortunately, my teaching political science in Zimbabwe – was not possible. The dean flat out told me they do not hire foreign-trained PhDs. I hear things have since changed. We were also naïve and deeply in love (less naïve and still in love). My husband because he is who is made the dreadful move. He left his job, his career, his friends and joined me on a visa that would not allow him to work for at least a year. We had not put much thought into what this would look like.

Moving is hard. Moving and leaving your career behind is even harder, and love can’t always make it easier. It is human to find identity in the work we do. In the U.S. at every social event, the first question even before hello is always what do you do? This can kill someone’s soul. We also make friends at work, so if you are suddenly not working, it can feel like you have no purpose and you have no social circle.

I just listened to a great podcast on trailing spouses on the podcast uproot. Our story is not unique. In academia, the two-body problem is real, and expats face the same challenges all the time. A doctor, lawyer, teacher, or the journalist who finds themselves away from home in a country where they can’t work. It is tough.

In this new environment, I felt deeply for my husband and realized that my previous beliefs about the separation of money and love could not hold. By choosing to move for me, my husband had not only given up his income, but the gap in his CV was going to negatively impact his earning potential even after furthering his studies with another masters degree. I woke up one day and told myself that my income is our money. I have never had such clarity of thought about anything else. Before we got married, I had asked him what his dreams where, and he had mentioned things he wanted to do for his parents, and I had done the same. It became important to me that we achieve these goals. It is hard to enjoy life when your parents are not ok. I could never be married to someone who asks me to ignore my mother’s welfare. It was not easy, but it was what we needed to do, and I also realized that I needed to lead the effort. It is hard for people who have worked and supported themselves to ask or feel like they can make decisions about money when they are not bringing an income in the traditional sense.

It is a lot harder for men, I think. My husband like a lot of African men or men, in general, was raised with the understanding that his job would be to provide for his family materially. In my view, he was still providing by furthering his education, discussing things with me, sharing the household load, etc. but I understand that fundamentally this is not what he would have preferred. And – you know Africans talk a LOT — a whole other post on this.

Joint accounts with independent accounts

Eventually when we were both working, as many of my friends have shared we settled on having a joint account for our significant goals, an understanding of which checking account covers which bills and a pocket money allowance. It seems to me that many of my friends – men and women alike value having a side account for personal spending. I think this is important for folks who entered unions at an older age. We all bring responsibilities into our marriages, and it is ok to be able to deal with those things but with an understanding that the union has needs such as rent, bills, mortgages, etc.

All joint

A few friends married and dating shared that they prefer to have one account. A friend of mine said that this system encourages accountability. One friend living in Zimbabwe said it was just better to unite everything given the precariousness of the economy – you know where you stand. I like their explanation. For us given auto payments for work and my side business things I think my husband would develop an aneurysm from trying to understand what is going on.

Individual bank accounts (checking and savings) and split bills

For some people it is imperative that they be independent – each person has their private accounts, and they split all bills in the middle. Many of the friends who responded to my short survey said this worked for them because they have different spending habits from their spouses. A couple in their 50s told me that at this stage where the major bills are clear, it is just better to do it this way- causes less headache.

Another friend shared that she has read too many stories of men stealing from women so she would rather be in control. If you listen to Christian podcasts, they will tell you that separate accounts are bad for marriage. I think that advise without context is wrong. What is bad for marriage is putting people in situations that make them fearful. Perhaps as a couple shares their fears and anxieties about money, they can find a more middle-ground approach.

Secret accounts

I used to think that only women have secret accounts but turns out even men do. At first, I was like secret what??? But as my mom explained to me, things happen. What are some reasons for secret accounts?

- Not being on the same page about family support. This is a big issue for interracial/intercultural marriages. My African friends married to white partners shared that sometimes it is just hard to explain why you need to send money to your great-grand cousin uncle. In those cases, they keep a little bit of money aside to avoid conflict. I would love to explore this dynamic more

- The other person is just horrible with money- someone said I love my partner, but their spending is bad for my future. A lot of people have real issues with debit- credit cards, gambling, etc. Their problem is not who they are, but it can put the union at risk. Read this crazy story about a Harvard Law School professor who unknowingly rented out his family home after almost selling the house. Crazy things happen!

- Lack of trust or fear from past relationships- my once married friends told me that they always want to feel secure. Sometimes the wounds from our past take a long time to heal, and maybe this is just what someone needs to feel safe.

So what is the best way of dealing with money in a relationship?

There is no one size fits all. An adult onesie for our issues would be great. Here are my thoughts though

- Be honest with yourself about what you like, your fears and what you prefer

- Be honest with your partner about all of the above

- Budget together – a written budget not an imaginary budget we are not in kindergarten

- Develop a set of goals for the union (e.g., buying a home, car, kids tuition, retirement) individual goals (e.g., furthering education, yoga, running, gaming)

- Agree on a plan to pay off debt

- Set up an emergency fund

- Contribute to individual retirement accounts and children’s education funds

- Buy life insurance

- What is left you decide – pocket money allowance, joint spending account, etc

*When your money is planned for, and the goals are clear, I think most of the money tension melts away like ice cream on the hottest day in Victoria Falls.

Hey friend- these things are hard. You are doing the best you can. No union is perfect, but you are perfect. We make mistakes, we learn, we grow. I am sending you love and light.

By the way: Not a certified financial advisor – these are just some thoughts 🙂 Let me know what you think

Jul 31, 2019 | Money Professor

UNSUBSCRIBE

Sorry about the cheesy – salesman type headline. I wasn’t sure how else to share this important message.

So here is the thing – on my birthday I received a lot of happy birthday emails from credit cards, stores I frequent like Victoria Secrets (I hear it is now canceled – my wallet is thankful), Bath and Body, ish this beautiful shoe store that promises you handmade shoes, clothes stores, etc., etc

Is your inbox full off offers? Mine is 🙁

From Chipo’s email

Also from Chipo’s email

Chipo suffers from FOMO, so this hurts

I get a ton of these emails every day. I share my email address to get a discount, and before I know it, I am spending more than I need to. You can use unroll to unsubscribe from several stores all at once or do it manually as you get the emails.

Raise your hand if you have ever clicked on a promotion link and ended up spending $100 or more- be honest. Honesty is the only way this relationship between us will work.

Stores know how to pull at our heartstrings; they also know that everyone likes to feel like they are getting a good deal. As a reformed (reforming is more accurate) shopper I can confess that you are not getting a good deal if you are buying things you do not need. If you spend $100 after 25% off, you did not save 25% you spent $100. If the $100 was not in your budget, then you have stolen $100 from yourself.

Strategies to deal with online shopping struggles

- Set a monthly budget – is shopping for item X included in your budget for this month? Yes-continue to X website No- get off the internet and run five laps in your kitchen.

- Unsubscribe – you do not need notifications to spend your hard-earned money or to sink into more debt

- Write down things you may need to buy but that are not urgent. I need two new blazers for work, shoes and work pants. All my shoes have developed holes – how is this even possible? Granted I walk everywhere, but this is quite stressful.

- Figure out how much you can afford for the things you need but that are not urgent

- Delete your credit card information from stores. I know that if I have to re-enter information, I am less likely to finish the purchase.

- Marie Kondo your closet or home –

- Clothes- If you have not worn something in a year (unless you have some legit reason like being pregnant), then it has to go. You can sell any clothes you no longer need on threadUp, donate to charity, or do a swap with friends.

- Household items- if you have not used something in a year, it should go – sell the items on craigslist or have a garage sale. Alternatively, donate any extra stuff to a nearby church they always have families in need for bits and odds

-

Wait – give yourself 24 hours after putting something in your cart before you buy it. If you forget about it then it wasn’t important

- Track your savings – focus on your financial goals. There is something you need more than another pair of $100 yoga pants. It hurts me to say this because yoga pants are the best. Have you seen these new office yoga pants? Phenomenal. Do I want them? Yes- do I feel that I deserve them- of course, I do. Should I get them? No, because we have goals booooooooooo

- Consider participating in a no spending week – I will write more about this. I am trying this shopping fast where I for a week without buying anything -not water, coffee or even cherries (this kills my soul). We still do our weekly groceries during that week, but we do not shop for anything else.

This is the goal – SAVE and watch your piggy get fatty fatty

Jul 24, 2019 | Money Professor

From https://www.cnbc.com/2017/09/19/i-was-shocked-by-how-much-it-turns-out-i-spend-on-food.html

I love food. I love yummy food. I bet you too love food or at the very least, see the need to eat. A variety of studies suggest that many of us around the world spend the majority of our money on food. Perhaps more importantly and sobering is that we tend to waste much of the food that we buy. Food goes bad before we consume it, or we buy things we do not like.

From-https://www.mashed.com/89983/signs-spend-way-much-money-food/

Do you know how much you spend on food? Do you break down your budget to get a sense of how much you spend on eating out – the quick coffee (guilty), casual lunch, etc.?

In 2017, the average family in the U.S spent $7, 729 on food that is about $644 per month.

How much do you spend? We are spending between $240 and $400 for two people, including eating out. There is def more room to cut down our spending, so I am actively thinking about these things.

Thoughts on ways to stay within your food budget in no particular order

- Look at your receipt after every food purchase. Most of the times, people toss their receipt before checking how much they have spent. This is not very wise -for several reasons

- What if the cashier made a mistake and charged you for something you did not buy?

- What if you were overcharged?

- What if your rewards weren’t applied -get that rewards card? I also love keeping coupons for the stores we frequent

- Making a grocery list is the best way to stay within your budget and ensure that you have everything you need. Trust me, it is crucial. For the last few weeks, we kept forgetting to buy butter. Dry toast is a pain

- Be honest about the number of meals you eat at home and how much you eat out. You can tally up food expenditures from your credit/debit card report.

- Be honest about the food that you like and what you hate. The most significant waste on most of our food budgets is ingredients that go bad — the avg. American family is throwing out food worth over $2,000 annually.

- Educate yourself on the real cost of food – the price for bread, milk, eggs, and rice should generally be consistent across stores. If you are paying $5 for a loaf of bread you are probably spending too much -bread in wholefoods ranges from $2-$13 it is tough to imagine why anyone without special dietary needs would pay $13 on a loaf of bread. Eggs vary widely, but I would guess spending $2-$3 on a dozen sounds about right, a gallon of milk in wholefoods Is about $4- I am using wholefoods examples because it is the most expensive store, therefore, if you are buying groceries at a regular store and spending more than these numbers you may not be shopping right.

-

Try to make your lunch: When I worked at the World Bank, I was in love with the cafeteria, BUT I was spending at least $13 on lunch. This is not sustainable. According to the labor stats, people in the U.S. spend over $3k on eating out. The only way I managed this was because I was paying subsidized rent for my friend’s extra-large closet/guest bedroom. I like to keep my lunch simple – 3 pieces of fruit (mostly because I start on my lunch as soon as I get to work. I believe there are support groups for people who do this – do not judge me). A small tin of yogurt and P&B sandwich. No need for reheating (most work microwaves can be nasty) reduce chances of fighting office Becky for eating your lunch lol

*If you do like buying lunch be honest about the cost and factor it into your monthly budget

- Make your meals at home- I am not a good cook, so I understand the anxiety around cooking.

- Benefits of cooking at home

- You know everything that goes into your food

- You can control sodium intake

- Takes less time than eating out

- Can be therapeutic

- Leftovers can make a great lunch option

- You save a lot

- If for some reason your lifestyle (or skillset) does not allow for cooking at home

- Budget your meals and be honest about your expenditures

- Get well acquainted with the food options around you and have a list of budget-friendly options. If you live alone eating out can be good for the budget if you prefer exotic meals with plenty of ingredients

- Buy food you enjoy – the worst is ordering a $20 meal then throwing it all out

- Eat what you buy

- Shop the outside aisles – the middle is packed with items that will hurt your wallet and your health.

- Get to know your grocery store- if you know where the things on your list are located then you will be able to stick to your budget

- Avoid big box stores – this is controversial, but I do find that unless you have a big family shopping at Costco can hurt your budget. Do you really need 20 gallons of spaghetti sauce for two people?

- Try to go to the smaller local stores that offer fewer brand options per product. We have found Trader Joes to be budget-friendly because they have fewer options, and their quantities per item are small enough for us to consume within a week.

- Do buy in bulk dry goods that you use often- we make rice at least 4 times a week, so I get this 10lb bag of rice online from Walmart when we buy our cleaning supplies. There is no difference between Walmart and whole foods rice. Do the same for pasta, spices and any sources you like. In Harare, I go to the Mbare market for all our long shelf veggies and grains. We always get to the market by 7 am for the freshest products and great bargain prices.

- Go to the grocery store just once a week. Yep! You will save a lot of money that way. Of course, we all forget things that we need for a meal but if you can avoid a midweek run do it. We once forgot to buy tomatoes – a midweek run for tomatoes ended up costing us $30 because suddenly we realized all the other things we “absolutely” needed.

- So how much should you spend on food? Try using the 50-20-30 budgeting system where you automatically save 20% of your take-home salary, spend 50% on necessities like housing, debt payment and groceries (10%), and 30% for flexible spending or additional savings.

- More importantly, track your food spending – each family is unique. Health and financial needs shape what we can afford to spend. Don’t stress 🙂 Relax, breathe and then … stick to a single shopping day, write down your grocery list, take note of what you like to eat, and the budget should work out. Honestly, I am not even YOLO about this – honesty with yourself is the first step to making good financial choices.

Chipo confessions: we like wine, we like ice cream, we like salmon, and we buy two different types of bread because -different needs. We have found a way to stay within our $100/week budget even with these splurges.

REMEMBER: I am not a financial advisor these are simply my thoughts

Jul 20, 2019 | Money Professor

CREDIT CARDS

Disclaimer: Not a financial advisor – just sharing my thoughts

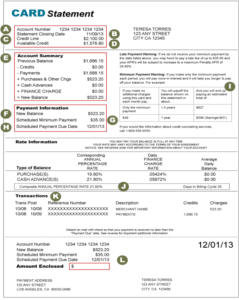

So, credit cards – yay or nay? Given all the trouble they seem to be causing my gut response is no. I know that many of the Financial Independence people like Dave Ramsey, Chris Hogan, etc. would tell you no credit card and to pay for everything in cash. The idea behind this way of thinking is that you won’t abuse what you do not have. Credit cards are a trap. Now, before you roll your eyes, remember that banks are capitalists. They are not your friend. Banks want to make as much money as possible. Think of it this way- Bank of America, Chase and Wells Fargo give tiny interest rates for their savings accounts. They provide interest rates between 0.03% and 0.75%. These rates are insultingly low. Compare these terrible rates to what they charge in interest for credit card purchases. Some rates are as high as 27% APR. They use your savings to make themselves rich. They will use you to get rich if you miss payments or only pay the minimum balance. Learn more about reading your statement here.

Do you hate credit cards?

If you hate credit cards you are not alone. My husband, who really should be writing this blog because he is better with money than me hates credit cards. He prefers to pay cash (debit card) for everything. I am more flexible, but I understand his concerns and agree that he is right, so we have found a middle ground. You can read more about the credit card free life from Rachel Cruze, two families interviewed by Nerd Wallet, a spender who is now watching her wallet and this Forbes piece.

When I was growing up in Zimbabwe, no one in my family had credit cards. My parents paid cash for everything, and they did not believe in loans -their mortgages were paid off decades before I was born.

I am not sure that I ever had a choice in the matter of opening a credit card account. The first week of college banks came to campus, we opened accounts we got credit cards, and that was it.

While I think a credit card free life is probably ideal for most people, I am not sure that it is practical. We recently bought a new car and our credit score mattered. I think the rules are even stricter if you are a black immigrant.

Let us be honest –

Most of us will not stop using credit cards so we might as well learn strategies to use them wisely.

- Do not open a million credit cards. You only need to show that you can pay your bills on time to build your credit history so no you don’t need a credit card from every store

- Closing cards will not hurt your credit score – even if it did- bad credit habits are more harmful than just closing off cards that are burdening you.

- Pay off your entire balance every month

- Pay off your balance on time – the due date is not a suggestion

- What if my salary pay date changes? Simply call your credit company and ask to change your due date. Changing your due date is not impossible

- Do not go over your balance- seriously don’t

- Avoid cash advances. The interest rates and associated fees are not worth the headache

- Do not fall for the 0% APR offers. Very few people actually pay off the balances within the stipulated time frames.

- Do not play the revolving 0% APR game- nothing hurts your credit score quite like revolving debt. Also, that is just stressful.

- Do not spend on things that you can’t afford. If your debit card balance is lower than the price tag for whatever you want to get, then you can’t afford the purchase

- Do let the credit card work for you-

- Save for big purchases and pay for them with your credit card to take advantage of rewards. I pay for flights and furniture with a credit card and pay it up with the savings. We have our cash rewards set to auto-transfer into our fun fund.

- Do use a credit card while abroad because if it gets stolen, it is usually much easier to cancel

- Do get an understanding of rewards available to you – some cards give 2% for every purchase, 3% for groceries, etc

- Do use a credit card that provides insurance for big purchases. In graduate school, I treated myself to an iPad only to have it stolen. Big City problems. American Express protects most purchases for up to 90 days, so I was able to get a replacement

Jul 20, 2019 | Money Professor

CREDIT CARDS

Pic from bankrate.com

Disclaimer: Not a financial advisor – just sharing my thoughts

So, credit cards- so much to think about.

This first post is for those who want to learn how to read their statement. The next post will be on the benefits and advantages of using credit cards.

Do you know how to read your credit card statement? There is no shame in not knowing how. It took me years to fully understand how credit cards work.

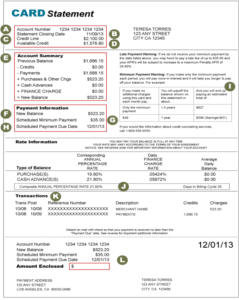

Figure 1: credit statement from handsonbanking.com

- Your account number -do not share this with anyone

- Statement Closing-The day the bank created the statement-this also determines how much you need to pay for the month

- Credit line- This is your spending limit. How much you can borrow

- Available Credit- how much loan access you have to.

- ACCOUNT SUMMARY – activities on your account.

- Previous Balance- What you owed in the last month

- Payments -what you paid towards the previous balance

- Purchases and other charges – if you bought anything this month the amount will charge here

- Cash advances- Try and avoid these – this is when you get actual cash from the credit card. The interest is a lot more. You do

- Finance Charge- interest charged if you did not make payments toward previous balance or if you made a partial payment

- New Balance- if you did not carry over a balance from last month and did not make any other payments your balance should be = purchases and other charges

- New Balance – What you owe this month

- Minimum Payment- This is the least that you should pay each month to avoid penalties. You can pay more -highly advisable to pay more or all of your balance.

- Scheduled Payment Due Date – This is the final day for you to pay your bill (F). If you do not make a payment, you will get hit by LATE FEES + INTEREST + WHATEVER ELSE THEY WANT

- MINIMUM WARNING- Banks are required by law to inform you how long it will take you to pay off your credit card if you just pay the minimum and how much it will cost you.

- Rate Information: How your fees and interests are calculated- IMPORTANT –most cards can start with a promotional rate -say 0% for 12 months. If you make late payments, you can lose that. After the year is over the rate might increase to something like 24%. They also have different rates for purchases and cash advance with CA always having a high rate.

- Transactions- the list of purchases and payments you made. Double-check that you are only being charged for what you spent on.

- Payment coupon -repeats all the payment information

Discussion