This should have been the first post, but it will likely not draw much traffic, so it is not the first post. When I received my first paycheck in college, I was so disappointed by how little I was making. I had worked for TEN HOURS! But the paycheck was so small. Who was this other person taking my money?

So little money

I was away from home and very new in America. I had no one to explain my first pay stub to be me. I am sure many of you have had this same confusion. In this very short post, I attempt to break down the pay stub. This will help make other things clearer as we move forward. Please forgive me – I am a teacher and tend to over-explain. Ignore what is not helpful. (But students do not ignore me in class- everything I say is IMPORTANT! LOL)

First job – yay

How much do I make? Whenever you signed your contract there was a number on there. The figure is likely what made you choose that job over others. Chipo has landed her first job after college and she will be making $60 000 a year. Chipo will likely divide that amount by 12 to get a ballpark monthly salary

$60 000/12 = $5 000

Chipo will be very happy with this number. She will assume that all her expenses will be met but she is WRONG.

What does a paycheck look like?

This is for the benefit of Generation Z who have probably never seen a physical paycheck. I also know that some of my millennial friends in Zimbabwe have never had a job and therefore they have never seen a paycheck either.

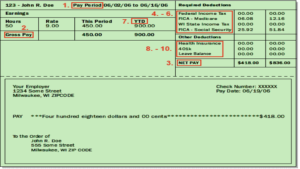

The image above is from the igrad their page has a lot of good financial resources.

- Pay period –

- this is the work period that you are being paid for. If you make an hourly wage you want to make sure that the dates are accurate. I make a fixed salary now, so I do not pay much attention to this.

- This is also important because some employers send out paychecks bi-weekly instead of monthly. You will need to know this to plan your savings strategy or for setting up your bill pay dates

2. Earnings

- Hourly rate – if you get paid hourly like John Doe here you will need to confirm that your hours have been inputted correctly.

- Over time – if you work more than 40 hours for 50-hour weeks then the additional 10 hours for that week will be paid at a higher rate of 1.5 your hourly rate.

- Gross pay

- This is your full earnings BEFORE any deductions in the example earlier this would be what Chipo calculated to be $5000 or $450 for John Doe

- Net Pay

- This is what you get to take home after the deductions

What is taken out before you get your actual paycheck

Required Deductions: Federal Tax, State Tax, Local Tax, FM TAX

You CAN not opt out of these deductions. Everyone has to pay for them. These are the monies that keep a country running and this also the reason that you should vote or engage in politics. From these standard deductions, your local and federal government pays employees, fixes roads, provides health care (or not) and education. The government can also loot and by themselves fancy cars at your expense. The explanation below is based on a U.S. system, but every country has something similar.

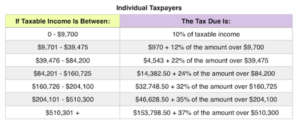

1. Federal Tax:

What you pay to the federal gov. There are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status, whether you are filling as a single person or as a married couple filing jointly. I am in the 21% tax bracket which hurts me inside a little.

2. State Tax

This varies from state to state. The 2019 tax rate for Massachusetts is 5.1 %. Just google your state and tax rate to find out your rate.

3. Local Tax:

This is rare but some localities have yet another tax. You may want to check this before you choose your next job- usually, it is not much.

4. FICA TAX

This is the federal Insurance Contributions Act, this is money taken out of your paycheck to fund programs like social security and Medicare. You really must pay attention to politics

5. MEDICARE-

There is a 1.45% tax on gross income for everyone to cover Medicare which goes towards health care for the elderly and disabled.

5. Social Security

This is the gov mandated retirement program. Everyone must pay in 6.25% of their gross income into the program. I just learned that you can check your social security benefits online. How many social security credits you have towards retirement or disability and benefits to your family in the event of death (so sad to think about). If you have been working in the US and paying social security then you have some benefits already. You need just 40 social security credits to benefit from the program. In 2019, you receive one credit for each $1,360 of earnings, up to the maximum of four credits per year. Generally, you need to have worked about 10 years to get social security benefits. It is a good idea to regularly log into your social security account online to check your benefits

The UK system is amazing -I just learned that after 65 everyone gets a nice pension. I am sure there are plenty of issues there too. South Africa may have something similar.

Voluntary-ish PRE-TAX DEDUCTIONS

Other deductions! I know it feels like it never ends – but the next set of deductions are a little more fun. They reduce your tax bill which is a nice bonus

- EMPLOYER-SPONSORED RETIREMENT 401/403 etc

More on this later – most companies offer various retirement options. Some offer a safe harbor contribution where you do not need to add anything in to get something. I just spoke to a friend who works for a university that REQUIRES all full-time people to put in 5% and they put in 9%. My university is wonderful. They will put in 9% whether or not I put in anything. They will also match up to 3% of my contributions which is great so each paycheck I have 15% going towards retirement which is really good.

2. MEDICAL FSA

This is a flexible spending health care plan. For example, this last year I set aside $500 for any co-pays (what you pay at the doctor’s office), I also use it for acupuncture (some policies allow), herbal tea, birth control (including condoms – seriously save tax on condoms). There is a lot you can do with it and in some cases, it rolls over. I also bought some sweet eyeglasses. Do you like my glasses? I need at least 2 pairs because every morning it is Tom and Jerry to find them.

3. HEALTH INSURANCE

Since Obamacare passed health insurance is now mandatory. Your employer puts in a portion and you do the same. More on this later but worth to mention that my husband and I found it cheaper to be on separate plans. I pay $118/month for my semi-comprehensive and my employer pays in $400. It is expensive but as I explained earlier it is worth it.

SOME ACRONYMS AND KEYWORDS

SM- MEDICARE

SS- SOCIAL SECURITY

FM – FEDERAL (M for Married and S for Single)

MA- Massachusetts for me so your State for you

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Discussion