Aug 19, 2019 | Money Professor

Emergencies -Yikes

Most financial gurus advise that you should have an emergency fund of at least six months of expenses. This is really good advice. However, I feel like the emergencies are expected to stop while I build my fund. As if there is a pause button that we can press then click resume when we are all saved up.

Maybe it is just me, but sometimes it does feel like the emergencies pop up every month, every week or sometimes every day. I am not thinking about black tax which I write about here because fixed bills are something that we can plan and budget for.

For those of us from communities where we are expected to help out family and friends, this means that we are continually responding not just to our emergencies but those of our family members and there we have a lot less control.

For our households we can put several protections in place like

- Car insurance to cover you in case of an emergency

- Health insurance and the various FSA/HAS plans for health care emergencies

- Life insurance

- Short- or long-term disability

If we get sick (knock on wood) we will most likely not go bankrupt. If we are in a car fender bender, we are covered, but this is not the case for our families back home. For most of us in the diaspora or if you are the one earning a little bit more, you are the emergency fund.

There are no safety nets in most African countries – maybe I can speak to the Zimbabwean experience, but I know this is true for friends in Ghana, Nigeria, Kenya, etc. I read a recent blog post that said when you return home to the continent be prepared to be your own state providing electricity, clean water, and I would even add sometimes managing road construction.

The hard thing is that a lot of the emergencies that find their way into our phones are real emergencies. People get sick; people are in accidents (thanks to poor infrastructure and overcrowded taxis), parents are asked to top up tuition because the economy sucks. Someone finds themselves with a considerable shortfall for a life-changing opportunity because the economy tanked.

Let us list some acceptable emergencies for you to agonize over

- Health –

- Death – death is terrible and often unexpected even when it is it is honestly a crappy thing to deal with

- A home disaster like a fire or flooding – even in cases where one has good insurance payouts take a long time to come. This is just a terrible situation to find oneself in

- Job loss in a crappy economy

It is important that we also clarify things that do not count as emergencies for which you should feel 0% guilt for saying no to. Say no for any of these requests that come with a 48-hour window for your response.

- Wedding contributions- I will give a wedding gift, but I will not contribute to solicited requests for group funding. No one is required to get married. Literally no one.

- Tuition – for the child or the parents. Seriously, my mother was a cross-boarder trader who paid my tuition. No-school fees is not a surprise except if a parent dies, then I think God calls on us to support orphans.

-

Trips – what is with all these never-ending church trips? If papa prophet wants you to take a trip, then he should pay for it. If you cannot pay for a trip, then it is not in your spiritual path to go on the trip.

- Baby things – I will buy a gift, but parents have nine months to prepare for a child unless the ask is for health-related matters then yes! Agonize and pray over this. We do not want babies to suffer.

- Fixing a broken car – yeah no

- Home improvement – def say no. Also, if you do not own a home, you have no business involving yourself in people’s home projects.

- Insert yours here

Of course, these are my lists. Even with these lists, I still agonize over the asks that come my way. The reason you need to have a list is so that you can quickly decide if the request is something you should stress over, especially when funds are tight. Do not take any debt to cover the non-emergency list because that is not a smart thing to do.

How do we budget for emergencies that are not ours?

- Set aside 10% of your income forgiving. It is your choice if you do so before or after tax. If you are in a position to give, please do give. It is very good for your mental health.

- Distribute your giving income between areas that you value – for me; it is church and family/friend emergencies.

- If you lose a parent or your parent is not well, you also have the option to borrow from you Roth, but this is the last resort. If it is within your means, get health insurance for the parents and some life policy.

How do we work towards saying no?

- This is hard, and there are no easy answers

- Write your $0 budget. If you do not have the money, you will not be lying if you say no

- Be honest with people on why you are not able to help at that moment

- If the above does not work, then make a list of who you can turn to in an emergency – if the list is blank then you really need to save up for that emergency fund.

Apr 30, 2019 | Money Professor

I love that a lot of my friends are brilliant and well-educated women. Girls Rock!

When I first started thinking about personal finance, I asked my girlfriends if they had a budget. The popular answer was “kind of.” Some said they felt that a budget was useless because in most cases we hardly stick to it because life happens. Indeed, life happens.

It also occurred to me that while every personal finance blogger tells people to have a budget very few actually do something like budgeting 101 or budgeting for dummies to give the average person like me a real sense of how budgeting works or should be done. In this post, I attempt to do just that.

What is a monthly household budget?

I was raised by a trader. My mom crossed the border between Zimbabwe and South Africa, Botswana, Zambia and occasionally Mozambique selling different crafts from Zimbabwe. In fact, I was once nearly stolen on the train when she took me to South Africa as a baby. I bring this up because most people in my life have been employed informally. Back when the Zimbabwean economy worked traders could plan their lives send kids (me) to good schools, live middle-class lives and pay their bills. All over the world, the middle class is feeling a little bit of a pinch. The cost of essential commodities is rising faster than people’s salaries, and this makes it a little bit harder to plan for the immediate future, and the long term is often left out of the equation.

Your monthly budget is a plan or a road map for your finances.

Step 1. (HOW MUCH MONEY DO I HAVE)

Be honest with yourself in terms of your income. How much money do you earn per month? If you have a regular job how much are you taking home after the government takes its share and all your other deductions? If you are self-employed, you may want to calculate an average from the last 6 months. Or as my mother would do – make a budget based on your two lowest earnings over the previous 6 months. Unless you have a fancy high paying job in the tech industry your monthly paycheck will likely stay the same for at least a year – the economy – right!

Step 2. (WISH LIST)

What are the things that you need to live from month to month? Primary needs vary from person to person, but generally, these include (not necessarily in this order):

| Household Expenses |

| Mortgage/Rent |

| Car loan |

| Car insurance |

| House insurance |

| Life insurance |

| Childcare |

| Parental Care |

| Remittances if different from PC |

| Charitable giving and tithing |

| Gas/electricity |

| Telephone |

| Cable |

| Internet |

| Food |

| Gas/electricity |

| Pet supplies |

| Healthcare |

| Entertainment |

| Gifts |

| Clothing |

| Security |

| Tuition (it helps to divide the annual cost by 12) |

| Travel (this is a HUGE cost in our house) |

| Other |

The best way to figure out how much you spend is to go over your past bills. Try to be as honest with yourself as you can.

I always try to start off the year with a budget breakdown. I am changing jobs, so this is a perfect time to redo the budget and think over my finances. This is a rough draft and a lot more complicated because we do not know for sure yet what our final income will look like and the actual expenses, but this should give you a general idea of how we are thinking about things. I also call this my dump it in all list. We start out by listing all the major expenses (after tax) then we will adjust as we go forward. We are trying to budget about 80% of our combined income – we assume that the real costs will be higher so we will adjust the income portion accordingly. The income from my businesses is pretty set, so there is no wiggle room there.

Step 3: DO THE MATH

Plug in the numbers – before you worry about what financial experts say about proportionality just go ahead and do the math to see where you are. Especially on your basic needs. Doing this will help you readjust as needed for long term planning. Your budget can be very fancy, but I like to keep mine simple. This is an easy to use template from mint.com

| Monthly Budget Template |

|

|

|

|

| Monthly income for the month of: _January 2020___________ |

|

|

|

| Item |

Amount |

proportion |

| Salary |

1000 |

|

| Spouse’s salary |

1000 |

|

| Dividends |

|

|

| Interest |

|

|

| Investments |

|

|

| Reimbursements |

|

|

| Other |

0 |

|

| Total |

2000 |

|

|

|

|

|

|

|

| Monthly expenses for the month of: ___________ |

|

|

|

| Item |

Amount |

|

| Mortgage/Rent |

400 |

20% |

| Car loan |

|

|

| Car insurance |

|

|

| House insurance |

|

|

| Life insurance |

|

|

| Childcare |

|

|

| Charity |

|

|

| Gas/electricity |

|

|

| Telephone |

|

|

| Cable |

|

|

| Internet |

|

|

| Food |

200 |

10% |

| Gas/electricity |

|

|

| Pet supplies |

|

|

| Healthcare |

|

|

| Entertainment |

|

|

| Gifts |

|

|

| Clothing |

|

|

| Other |

0 |

|

| Total |

600 |

|

|

|

|

|

|

|

| Income vs. Expenses |

|

|

|

|

|

| Item |

Amount |

|

| Monthly income |

2000 |

|

| Monthly expenses |

600 |

|

| Difference |

1400 |

|

The first time you do this, you may find out that your actual budget is more than 120% of your income. I have done this too- but I find that the visualization really helps.

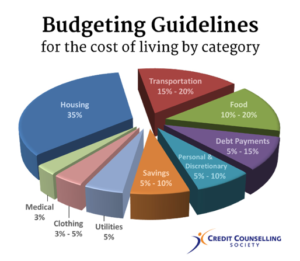

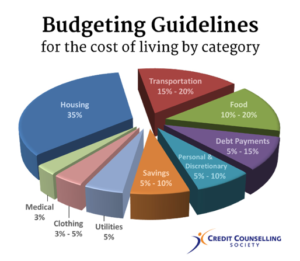

Ideally, you want to balance out your budget so that you are spending between 30 &35% of your gross income (pretax) on housing, 15-20% on transportation, 20-20% on food and less than 15% of your income should be going to debt. It is also recommended that you save at least 5% of your income but if you can save 20% including retirement and health care contributions that will be really good. But remember, aggressively saving should only happen when you have paid off your debt.

Here is an example of our budget for the next phase of our lives. I prefer using excel and color coding the budget.

| MONTHLY INCOME EXPENDITURES |

| Account |

Proportion post-tax (net) income of 80% net of both spouses |

Proportion of pre-tax (gross) income |

| household Fixed |

|

|

| Rent |

31% |

23% |

| Cellphone Bill |

1% |

1% |

| car payment (60-month finance) |

6% |

4% |

| Health care (co-payments, Yoga and Biking) |

3% |

2% |

| parental care (child care for others) |

15% |

11% |

| Monthly Groceries |

6% |

4% |

| car and renters insurance |

2% |

2% |

| Utilities (electricity and water) |

1% |

1% |

| PRE-TAX CONTRIBUTIONS |

|

|

| health insurance (pre-tax) |

|

6% |

| dental (PRE-TAX) |

|

1% |

| vision (PRE-TAX) |

|

0% |

| Uncle Sam |

|

15% |

| Retirement contributions 403 or 401k (PRE-TAX) |

|

6% |

| POST-TAX SAVINGS |

|

|

| Amex Savings (long- and short-term goals minus EF) |

16% |

12% |

| Acorns Roth plus tiaa Roth (investment for dummies) |

3% |

2% |

| Emergency fund monthly contributions |

2% |

1% |

| MEH ESSENTIALS |

|

|

| cable and internet |

1% |

1% |

| Car fuel (transportation) |

1% |

1% |

| charitable giving |

1% |

1% |

| Eating out and entertainment |

1% |

1% |

| Clothes and other fun shopping |

1% |

1% |

| Travel (non-reimbursable) |

1% |

1% |

| Laundry |

0% |

0% |

| FAMILY SUPPORT |

|

|

| Remittances- tuition for niece and nephew |

1% |

1% |

| Remittances family 1 |

1% |

1% |

| Remittances Family 2 |

1% |

1% |

| FAMILY FUND (contributions for funerals, health, weddings, etc.) |

1% |

1% |

| Debt free 🙂 |

0% |

0% |

|

|

100% |

| TOTAL MONTHLY EXPENSES as a proportion of net and gross |

98% |

68% |

| Source |

Percentage of post-tax income |

|

| BOA standing |

|

|

| Account left over from month to month. |

|

|

| Spouse 1 salary after significant deductions (health care) |

61% |

|

| Spouse 2 portion of salary after deductions (only 33% of income) |

33% |

|

| business 1 income |

4% |

|

| business 2 income |

2% |

|

| Note: this is based on just 83% of our combined income. We are hoping to adjust our expenses to live on only one income in the future. Our actual tax bill to Uncle Sam is 21% this is lower because of some minor adjustments we are working on. We also recently discovered that we underbudgeted travel last year so we will need to clean that up. We are paying more on our car note to try and pay it off sooner -the actual bill is just 3% of our gross income. Although we have met our emergency fund goals, we want to keep growing it with hopes of increasing our family fund contributions as well as our charitable giving. |

Just adding the colorful version here because it is so pretty

Step 4. TEAMWORK

Clean up the budget. If you have a partner the assumption here is that you are working together or as is the case in most unions one person will build the budget skeleton, then the team will sit down to clean it up and adjust numbers. I will also write an entire post on how to have the money talk with your spouse and partner. If you are living in a volatile economy, try very hard to plan with inflation in mind or change some of your money to a more stable currency to give you some peace of mind. If this is not possible, please share some tips and strategies, you have used to stay on track.

Step 5. CASH ONLY

Avoid using your credit card or loans to fill in the gaps. Access to credit can create a false sense of stability. Most financial gurus advise against using credit cards for this very reason. Use cash (checking account, mobile money, etc.) as much you can.

If you do use your credit card, schedule auto payments for the beginning of each month. I like to use credit because I get points, but I am also vigilant about paying off expenses each month. Credit cards are a trap that you should really try to avoid.

Do not budget with someone else in mind- for example, some will say Uncle X always sends money. This is a bad habit. Unless you have some reason to believe that uncle X will show up, do not burden someone else.

Step 6. NO MONEY FOR FUNSIES -JUST KIDDING- NO SERIOUSLY, NO MONEY FOR FUNSIES

Cut out non-essentials and live maybe 10-20%below your means. If you cannot afford to pay cash for something, then you do not need it. If an expenditure is causing you sleepless nights, ask yourself if it is worth the stress and increase in your health care costs. If you cannot afford your car or house or house help service, you DO NOT NEED IT! If your kid’s tuition is a constant conversation in the family group, then you are probably sending your kid to a school that is out of your $ range.

Step 7: STICK TO THE BUDGET

Stick to the budget – I will devote a lot of time in the blog discussing some strategies for sticking to the budget drawing on my personal failures and successes. Please share your tips as well. I want to learn from you.

ADVANTAGES OF making A BUDGET and sticking to it

You are probably asking yourself – why bother? I think about my financial health as being closely tied to mental and physical health. If you sometimes stay up late crunching numbers, then you want to do this so that you can sleep better, but we can also just list out the reasons here

- Know what you need to be happy – this is great for negotiating your salary. After I finished my doctorate, I was offered a consulting job at a big firm. I was super excited and too scared to negotiate, so I accepted the first salary they gave me. The salary looked great on paper, but I was not going to be able to live in expensive Washington DC on those numbers. Now, when I get a job offer, I always try to negotiate for a salary at least 20-30% above my needs or current salary. Moving is expensive, and it is often the case that the cities with great jobs tend to cost a lot more

- REDUCE EMERGENCIES-I really believe that there are very few real emergencies. Everything else can be planned for. Your car breaking down should not make you bankrupt because ideally, you have an emergency fund to pull from. Child Care should not give you sleepless nights because while pregnancy can be a surprise, the arrival of the baby is not. Include health care costs in your budget early on. Having conversations with mom and dad about their health care will also reduce “emergencies” in the future. Funerals can be an emergency, but weddings are really not the same as children’s tuition, graduation, baby showers, and birthday parties.

- Saying NO- It is a lot easier to say no to unwelcome money requests when your money is budgeted for. In future posts, we will discuss long and short-term financial planning. It is a lot harder to say no to people we love when we have what I call idle – unaccountedfor money.

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Oct 18, 2019 | Money Professor

For academic conference organizers, attendees and anyone inviting us for talks

I like going to conferences. I think most academics do. I love talking about my work and getting feedback and hanging with friends in the academy

(side note: I quite like the academy- I know it is not fashionable to like your job but…).

The thing though is that as much as we all like going to conferences (big and small) and giving talks it isn’t cheap. The cost is higher on graduate students who get a tiny share of the funding pool.

Professor friends – I know you have research funds – why aren’t you using them to help fund travel for your graduate students?

I do not even have graduate students, but our school gives us money to pay for our students to go to conferences with us. It is a lot easier for professors, especially tenured faculty, to find more money than it is for graduate students. Topic/rant for another day

So how do we financially prepare for conference/talks travel

Sources of funding

- Know your allocated travel funds – every school or let me say most schools have some travel allowance. When I was a graduate student, we had an allowance of $250 -which is cray, but we can discuss that later

- Make a list of all possible sources of funding for travel – my faculty mentor gave a list of at five sources that I did not even know existed

- Always ask organizers if they have a budget to cover your travel needs – this works – trust me

- Investigate possibilities for funding via the conference or affiliated organizations

- Most conferences have funding for students – recently there was a twitter storm about tenured people applying for student funding – we should all have more shame

- Some conferences have targeted funding for minorities

- Attending workshops before the conference might come with free travel and or housing

- Volunteering to help with some activity might also come with complimentary travel

- If you have a co-author, you may have the option to use some of your travel funds to cover their travel.

- You might be able to use travel awards to cover childcare – double and triple check with your school

Planning for travel

- Understand all related costs. The obvious ones are hotel and airfare but some small things to keep in mind-

- Travel to and from your home to the airport – this is huge for me. To get to the airport from Wellesley, I have to pay $80. That means a total of $160 unless I drive and park at the airport, which is neither cheap nor convenient for me. I could also ask my husband to pick me up, but that sucks if I get back at night – he has to be up at 5 am for work, so yeah, we are not doing that. Taking the bus is an unnecessary 2-hour journey. Uber is not an easy option because – Wellesley

- Meals during travel – coffee, bagels, lunch all add up- you also want to make sure you are eating healthy wholesome meals to avoid travel fatigue and sickness ($20 for the day or more depending on length)

- Luggage – black hair products, shampoo, lotion, bathing gels, etc. all require that I check in my bags. Hotel shampoo, conditioners, and soap are not designed for black bodies ($50)

Ways to cut costs

- Itemize your travel budget, so you know what to expect

- Build a relationship with taxi/car service if you live in the middle of nowhere – often they can give you a discount or override surge rates

- Buy bulk travel size supplies – I regularly stock up at bath and body when they have sales

- Buy bulk travel snacks – trader joes has some good size snacks

- Pack easy to carry fruit like apples, banana and 3oz yogurt (also trader joes)

- Eat a good meal before you leave home

- Book travel with an airline credit card to get double miles and free luggage check-in

Suggestions to expedite reimbursements

- Ask if your school allows for travel advance that way you are not out of pocket for a long time

- Complete reimbursement forms for each trip from the moment you make the first purchase – e.g., when you buy your air ticket

- Take pictures of every receipt or use an app to capture and store receipts – this is great when you are in the field

- Keep a small wallet for all your receipts

What other strategies do you use?

Aug 26, 2019 | Money Professor

This post is on thoughtful giving and things I learned from my mom

So maybe I am feeling a little sentimental because of some good things happening in our family, or perhaps it is that school is about to start. The start of school makes me happy for several reasons- the top of which is the arrival of international students in the US. I love getting to meet the students, especially those who have gone through a lot to find themselves here. My heart is filled with hope each time I learn of a young kid coming out of the refugee camps or a kid who has managed to live with very severe disabilities to make it to college. There are many inspiring stories. Common among them is the fact that the world is full of kind of people who donate in cash and in-kind to open doors for others.

I do not want us to become cynical about money. Yes, we must save and achieve whatever goals we set for ourselves, but we are not islands. Do not feel bad if you have more responsibilities than your peers. I think a lot about compound interest these days and I have thought that our big families and the villages we come from or build for ourselves are also a function of compound interest.

One of the things that shocked me the most when I first arrived in America was homelessness. It takes a lot for someone to end up homeless back home. Our families will rather sleep 20 people to a room than have a brother, a cousin, an uncle, or an aunt sleep on the streets.

There was a point when mom’s house was home to at least 15 adults, including an aunt, her husband, and two kids, my sister’s friend and her two kids and so on. I am always indebted to my sister, who made room for me at her home even when their home was already at full capacity with at least six teenage nephews and nieces from her husband’s side.

This is the core of who we are. I know there are many of you hosting new immigrants, friends who find themselves on the street for many reasons and still managing the demands from big families and the politics that come with that. Thank you. I am giving you a big hug.

What I do want us to continue thinking about is ways in which we balance our responsibilities and grow our money to build generational wealth. While we can’t plan for every emergency and hardship that the world throws our way, we can plan to mitigate the impact of bad things by planning.

Giving lessons from Chipo’s mom

- Never pay less than you can afford: There was a trader who sold tomatoes on our street. Amai Beauty was her name. She had four kids around my age. Whenever my mom returned from South Africa, she would bring clothes for her kids and some groceries, so naturally, Amai Beauty always offered my mom a discount on her veggies. My mom always politely declined. Mom explained to me that Mai Beauty needed every penny, and we did not need discounted tomatoes. Even though we had a lovely garden with tomatoes, veggies, corn, oranges (YES!!!), avocadoes (thanks Dad) mom would buy from Mai Beauty.

I get frustrated when I read of FIRE movement people who brag about free-riding on their friend’s Netflix account or always looking to get free yoga classes. People who seek out free yoga classes aggravate me. If you can afford to pay for Netflix or exchange a Netflix password for Hulu/amazon with your friend, then don’t be a douchebag. If you are saving a bunch of your income to grow a net worth of 2 million, you can very well pay $18 for a yoga class. Yoga teachers spend a ton of money on training, so trying to cheat them just to see your net worth numbers grow is an awful thing to do.

- Making giving a part of your lifestyle: My mom is a hopeless giver. Before I came to college, I told mom that one of my friends had a full scholarship, but she would likely miss out on school because of the $800 airfare. Mom sent the money. I would later learn that doing so wasn’t easy for her, but mom was adamant that a young girl should not miss out on education because of the cost of an air ticket. I am more like my dad. I try to be a bit more systematic in how I give. I believe that you can set aside a small % of your paycheck towards charitable giving and that % will grow as your income increases.

Think about what you value and give towards that.

- College giving, I am a beneficiary of generous scholarships from Linfield College. I feel very strongly about giving back – I know that my $20 a month is not worth much – to maximize my donation I itemized the gift and directed it towards a need that is often overlooked by big donors. I have asked that my donations be used to fund textbooks for a low-income international student.

- Tithing – I have not always been able to tithe, but now that I am working, I love being able to support our church activities. I honestly do not tithe 10% since I distribute my 10% giving allowance across my many passions. My church family is a central part of my life. A healthy church is a gift. I have also been very blessed to be a member of churches that support homeless shelters, food banks, and give scholarships.

- Supporting family- when I got to college, I decided to help my mom by taking over financial responsibility for a few family members. I chose to pay tuition and provide a food allowance. The need is always greater than I can afford, but I firmly believe that we need to send as many kids to school as we can.

- No money – no problem – other ways to give

My mom can be annoying when it comes to preaching about giving and doing for others. Mom says money is not the most significant gift. Every time we talk, mom is running from one volunteer activity to another.

- Time – I will never forget that my second Sunday in America (many may years ago) I showed up to the first Methodist church I found. My now host mom (had been host mom to a Zim student -my now adopted big sis-) asked if I could teach Sunday school. The Sunday school teacher had suddenly quit. I was happy to do it – what I did not know then was that children’s ministry never has enough volunteers, so I was stuck for four years lol. I didn’t mind. Every Sunday (and later Wednesday evenings) I committed 3 hours. Most parents are happy to have an hour of adult time, and they appreciate having a safe space to drop off their kids. I also learned a lot about America from the middle schoolers, so I was winning too.

- Habitat for humanity: our church ran a lot of HH programs. We built a ton of houses for low-income families. If you have a habitat for humanity in your town, I highly recommend getting involved. You will learn a lot and have a ton of fun. I also bonded with one of my host moms during our many trips to various homes. A decade-plus later she put together our pre-marriage guide -see you always win

- Leading volunteer trips- obviously I did not have money to pay for various excursions in college -duh – Zim inflation was in the billion trillion % at the time so yeah. But one free thing is being a team leader, or you pay a reduced rate. People hate leading trips because it is a lot of work! One of my best buddies and I led a trip to the Navajo valley and woow – what an experience. What an experience! I also interviewed for my Carter Center internship during that trip, and the hiring team loved the beat of the pow wow drums in the background lol -YOLO! I got the internship. That experience and that has opened to many doors in my life, including a weekend with President and Mrs. Carter for the husband and me a couple of years ago. I also made life long friends 🙂 our class had some of the best humans I have come to know and love.

- Random volunteer things- try to give in ways that make you happy. Trust me – it is always worth it.

In summary

- Never ask for a discount from someone who needs the money when you can afford to pay full price

- Make financial giving a central part of your budget even if it is a small amount. If you are not sure of where to send money may I suggest

- The USAP school https://usapschool.org-also read their NYTimes feature here

- Local churches especially ones with a homeless shelter program and or a food bank

- Family members who need a financial boost

- Paying tuition for as many little boys and girls as you can

- Your alma mater

- Give your time – financial giving is just a small part of your giving life

- Instead of asking for a discount for services ask if you can exchange labor for a class

- Habitat for humanity

- Leading volunteer trips

- Children’s ministry

- Set up and breakdown at events

- Tutoring

- Big Brother Big Sister programs

- Food Bank – they always need people to clean up, organize the food and do deliveries

This week’s TV show suggestions because YOLO

Peaky Blinders

Into the badlands

Family Reunion on Netflix

Glow on Netflix

The funny or not funny JAniston and Adam Sandler movie

Four Weddings and A Funeral on Hulu

I am worried about my TV choices

Discussion