I love that a lot of my friends are brilliant and well-educated women. Girls Rock!

When I first started thinking about personal finance, I asked my girlfriends if they had a budget. The popular answer was “kind of.” Some said they felt that a budget was useless because in most cases we hardly stick to it because life happens. Indeed, life happens.

It also occurred to me that while every personal finance blogger tells people to have a budget very few actually do something like budgeting 101 or budgeting for dummies to give the average person like me a real sense of how budgeting works or should be done. In this post, I attempt to do just that.

What is a monthly household budget?

I was raised by a trader. My mom crossed the border between Zimbabwe and South Africa, Botswana, Zambia and occasionally Mozambique selling different crafts from Zimbabwe. In fact, I was once nearly stolen on the train when she took me to South Africa as a baby. I bring this up because most people in my life have been employed informally. Back when the Zimbabwean economy worked traders could plan their lives send kids (me) to good schools, live middle-class lives and pay their bills. All over the world, the middle class is feeling a little bit of a pinch. The cost of essential commodities is rising faster than people’s salaries, and this makes it a little bit harder to plan for the immediate future, and the long term is often left out of the equation.

Your monthly budget is a plan or a road map for your finances.

Step 1. (HOW MUCH MONEY DO I HAVE)

Be honest with yourself in terms of your income. How much money do you earn per month? If you have a regular job how much are you taking home after the government takes its share and all your other deductions? If you are self-employed, you may want to calculate an average from the last 6 months. Or as my mother would do – make a budget based on your two lowest earnings over the previous 6 months. Unless you have a fancy high paying job in the tech industry your monthly paycheck will likely stay the same for at least a year – the economy – right!

Step 2. (WISH LIST)

What are the things that you need to live from month to month? Primary needs vary from person to person, but generally, these include (not necessarily in this order):

| Household Expenses |

| Mortgage/Rent |

| Car loan |

| Car insurance |

| House insurance |

| Life insurance |

| Childcare |

| Parental Care |

| Remittances if different from PC |

| Charitable giving and tithing |

| Gas/electricity |

| Telephone |

| Cable |

| Internet |

| Food |

| Gas/electricity |

| Pet supplies |

| Healthcare |

| Entertainment |

| Gifts |

| Clothing |

| Security |

| Tuition (it helps to divide the annual cost by 12) |

| Travel (this is a HUGE cost in our house) |

| Other |

The best way to figure out how much you spend is to go over your past bills. Try to be as honest with yourself as you can.

I always try to start off the year with a budget breakdown. I am changing jobs, so this is a perfect time to redo the budget and think over my finances. This is a rough draft and a lot more complicated because we do not know for sure yet what our final income will look like and the actual expenses, but this should give you a general idea of how we are thinking about things. I also call this my dump it in all list. We start out by listing all the major expenses (after tax) then we will adjust as we go forward. We are trying to budget about 80% of our combined income – we assume that the real costs will be higher so we will adjust the income portion accordingly. The income from my businesses is pretty set, so there is no wiggle room there.

Step 3: DO THE MATH

Plug in the numbers – before you worry about what financial experts say about proportionality just go ahead and do the math to see where you are. Especially on your basic needs. Doing this will help you readjust as needed for long term planning. Your budget can be very fancy, but I like to keep mine simple. This is an easy to use template from mint.com

| Monthly Budget Template | ||

| Monthly income for the month of: _January 2020___________ | ||

| Item | Amount | proportion |

| Salary | 1000 | |

| Spouse’s salary | 1000 | |

| Dividends | ||

| Interest | ||

| Investments | ||

| Reimbursements | ||

| Other | 0 | |

| Total | 2000 | |

| Monthly expenses for the month of: ___________ | ||

| Item | Amount | |

| Mortgage/Rent | 400 | 20% |

| Car loan | ||

| Car insurance | ||

| House insurance | ||

| Life insurance | ||

| Childcare | ||

| Charity | ||

| Gas/electricity | ||

| Telephone | ||

| Cable | ||

| Internet | ||

| Food | 200 | 10% |

| Gas/electricity | ||

| Pet supplies | ||

| Healthcare | ||

| Entertainment | ||

| Gifts | ||

| Clothing | ||

| Other | 0 | |

| Total | 600 | |

| Income vs. Expenses | ||

| Item | Amount | |

| Monthly income | 2000 | |

| Monthly expenses | 600 | |

| Difference | 1400 | |

The first time you do this, you may find out that your actual budget is more than 120% of your income. I have done this too- but I find that the visualization really helps.

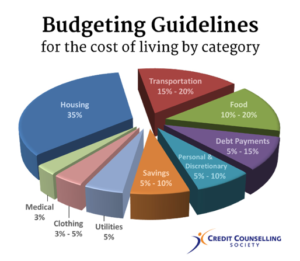

Ideally, you want to balance out your budget so that you are spending between 30 &35% of your gross income (pretax) on housing, 15-20% on transportation, 20-20% on food and less than 15% of your income should be going to debt. It is also recommended that you save at least 5% of your income but if you can save 20% including retirement and health care contributions that will be really good. But remember, aggressively saving should only happen when you have paid off your debt.

Here is an example of our budget for the next phase of our lives. I prefer using excel and color coding the budget.

| MONTHLY INCOME EXPENDITURES | ||

| Account | Proportion post-tax (net) income of 80% net of both spouses | Proportion of pre-tax (gross) income |

| household Fixed | ||

| Rent | 31% | 23% |

| Cellphone Bill | 1% | 1% |

| car payment (60-month finance) | 6% | 4% |

| Health care (co-payments, Yoga and Biking) | 3% | 2% |

| parental care (child care for others) | 15% | 11% |

| Monthly Groceries | 6% | 4% |

| car and renters insurance | 2% | 2% |

| Utilities (electricity and water) | 1% | 1% |

| PRE-TAX CONTRIBUTIONS | ||

| health insurance (pre-tax) | 6% | |

| dental (PRE-TAX) | 1% | |

| vision (PRE-TAX) | 0% | |

| Uncle Sam | 15% | |

| Retirement contributions 403 or 401k (PRE-TAX) | 6% | |

| POST-TAX SAVINGS | ||

| Amex Savings (long- and short-term goals minus EF) | 16% | 12% |

| Acorns Roth plus tiaa Roth (investment for dummies) | 3% | 2% |

| Emergency fund monthly contributions | 2% | 1% |

| MEH ESSENTIALS | ||

| cable and internet | 1% | 1% |

| Car fuel (transportation) | 1% | 1% |

| charitable giving | 1% | 1% |

| Eating out and entertainment | 1% | 1% |

| Clothes and other fun shopping | 1% | 1% |

| Travel (non-reimbursable) | 1% | 1% |

| Laundry | 0% | 0% |

| FAMILY SUPPORT | ||

| Remittances- tuition for niece and nephew | 1% | 1% |

| Remittances family 1 | 1% | 1% |

| Remittances Family 2 | 1% | 1% |

| FAMILY FUND (contributions for funerals, health, weddings, etc.) | 1% | 1% |

| Debt free 🙂 | 0% | 0% |

| 100% | ||

| TOTAL MONTHLY EXPENSES as a proportion of net and gross | 98% | 68% |

| Source | Percentage of post-tax income | |

| BOA standing | ||

| Account left over from month to month. | ||

| Spouse 1 salary after significant deductions (health care) | 61% | |

| Spouse 2 portion of salary after deductions (only 33% of income) | 33% | |

| business 1 income | 4% | |

| business 2 income | 2% | |

| Note: this is based on just 83% of our combined income. We are hoping to adjust our expenses to live on only one income in the future. Our actual tax bill to Uncle Sam is 21% this is lower because of some minor adjustments we are working on. We also recently discovered that we underbudgeted travel last year so we will need to clean that up. We are paying more on our car note to try and pay it off sooner -the actual bill is just 3% of our gross income. Although we have met our emergency fund goals, we want to keep growing it with hopes of increasing our family fund contributions as well as our charitable giving. | ||

Just adding the colorful version here because it is so pretty

Step 4. TEAMWORK

Clean up the budget. If you have a partner the assumption here is that you are working together or as is the case in most unions one person will build the budget skeleton, then the team will sit down to clean it up and adjust numbers. I will also write an entire post on how to have the money talk with your spouse and partner. If you are living in a volatile economy, try very hard to plan with inflation in mind or change some of your money to a more stable currency to give you some peace of mind. If this is not possible, please share some tips and strategies, you have used to stay on track.

Step 5. CASH ONLY

Avoid using your credit card or loans to fill in the gaps. Access to credit can create a false sense of stability. Most financial gurus advise against using credit cards for this very reason. Use cash (checking account, mobile money, etc.) as much you can.

If you do use your credit card, schedule auto payments for the beginning of each month. I like to use credit because I get points, but I am also vigilant about paying off expenses each month. Credit cards are a trap that you should really try to avoid.

Do not budget with someone else in mind- for example, some will say Uncle X always sends money. This is a bad habit. Unless you have some reason to believe that uncle X will show up, do not burden someone else.

Step 6. NO MONEY FOR FUNSIES -JUST KIDDING- NO SERIOUSLY, NO MONEY FOR FUNSIES

Cut out non-essentials and live maybe 10-20%below your means. If you cannot afford to pay cash for something, then you do not need it. If an expenditure is causing you sleepless nights, ask yourself if it is worth the stress and increase in your health care costs. If you cannot afford your car or house or house help service, you DO NOT NEED IT! If your kid’s tuition is a constant conversation in the family group, then you are probably sending your kid to a school that is out of your $ range.

Step 7: STICK TO THE BUDGET

Stick to the budget – I will devote a lot of time in the blog discussing some strategies for sticking to the budget drawing on my personal failures and successes. Please share your tips as well. I want to learn from you.

ADVANTAGES OF making A BUDGET and sticking to it

You are probably asking yourself – why bother? I think about my financial health as being closely tied to mental and physical health. If you sometimes stay up late crunching numbers, then you want to do this so that you can sleep better, but we can also just list out the reasons here

- Know what you need to be happy – this is great for negotiating your salary. After I finished my doctorate, I was offered a consulting job at a big firm. I was super excited and too scared to negotiate, so I accepted the first salary they gave me. The salary looked great on paper, but I was not going to be able to live in expensive Washington DC on those numbers. Now, when I get a job offer, I always try to negotiate for a salary at least 20-30% above my needs or current salary. Moving is expensive, and it is often the case that the cities with great jobs tend to cost a lot more

- REDUCE EMERGENCIES-I really believe that there are very few real emergencies. Everything else can be planned for. Your car breaking down should not make you bankrupt because ideally, you have an emergency fund to pull from. Child Care should not give you sleepless nights because while pregnancy can be a surprise, the arrival of the baby is not. Include health care costs in your budget early on. Having conversations with mom and dad about their health care will also reduce “emergencies” in the future. Funerals can be an emergency, but weddings are really not the same as children’s tuition, graduation, baby showers, and birthday parties.

- Saying NO- It is a lot easier to say no to unwelcome money requests when your money is budgeted for. In future posts, we will discuss long and short-term financial planning. It is a lot harder to say no to people we love when we have what I call idle – unaccountedfor money.

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Discussion