Oct 18, 2019 | Money Professor

A (maybe) controversial post on debit and credit

You do not need to have some debt to have good credit. You need to be able to use credit to establish a credit score/record, but you do not need to carry around thousands of debts in loans or consumer credit to have a decent credit score.

Debt is stressful. Debt can make you go crazy, and having monthly payments sucks. Monthly payments annoy me. We bought a brand-new car in December because our old car, which I bought in grad school (cash $3,000), looked close to giving out. However, it is a Toyota and no longer looks like it will die any time soon. Back to the car. All good advice says buy a used car, and I agree, except in this case our crossover SUV from Nissan was cheaper than any other used SUV we looked at lol. The Nissan kicks range between $17k to $20,000 brand-new. It is super basic with some excellent features. We wish it had more power, but it works.

I was telling a friend that we plan to pay it off soon (we are about 52% paid up), and she said, but you need a bit of debt for your credit score. This is false. I agree that for most people, especially folks of color looking to make big purchases like a home, we do need a credit history. There are many ways to do this – your phone bill, your cable bill, buying groceries with a credit card, and paying it off at the end of every month. My credit score is over 800, which is more than enough for getting a house loan when the time comes. A bigger focus should be saving for a down payment and staying clear of unnecessary loans.

Ask yourself these questions before you make purchases – do you want to make monthly payments for say underwear? If you buy underwear from Victoria Secrets and do not pay it off at the end of the month, you will most certainly be in debt (plus interest) for underwear. This is not necessary. There are other reasons not to support Victoria Secrets, but being in debt for undergarments is a top one.

If you have consumer credit, I suggest that you buckle down and pay it off. People use different strategies like

- the highest interest first

- Smallest debts first –

- Or mixed methods.

Whatever methods you decide on, you will need to pause on using your credit cards or borrowing until you are paid off. I prefer making minimum payments on everything and putting extra $ on the smallest debt first. I like seeing wins, so this works for me. When I was paying off debt, I customized the Dave Ramsey snowball method. I closed off two of my cards and negotiated a lower rate with the companies. This brought my credit score down to 705, which sucked, but I knew I would fix the situation faster this way.

I am also no anti-credit card. I love free things, so the rewards work for me. Every year we take a couple of trips for “free” using rewards.

I will do another post on my fav credit cards – I want to hear from you- which credit cards have the best rewards?

Apr 30, 2019 | Money Professor

The average individual in America has at least $5, 331 in credit card debt and many of them are unable to pay it. A lot of people carry debt from student loans. I was way above average. Being above average is really good but not in this particular circumstance. At its worst, my debt was $33, 051.70. Yep! I was keeping track of the cents. People in developing countries are not doing much better either on dealing with debt. Banks are predatory. I shudder every time I read something on the wonders of mobile money that does not address how easy it has become to get loans that have a ridiculously high interest rate and a very short payback period. In Zimbabwe, the average person is struggling to make ends meet as salaries fall way behind the rapidly increasing cost of essential commodities. And yet, banks are making healthy profits because they routinely partner with employers to offer loans with interest rates of over 20% in many cases. In Kenya, personal debt is also crippling with a national income to debt ratio of over 60%.In South Africa, people can buy groceries on credit. The national personal debt is over $15.1 bn USD. Only the banks benefit, but there are things we can all do to manage debt, get out of it and stay out of it.

The back story

So how does someone with excellent credit, no student loans, and reasonable budget skills end up in such a pit? Good deals! There is always a good deal, and if we are not careful, we can follow it right into the hole of fire. In this particular case, my business partner and I saw an opportunity to expand our business from “trunk of our car” to an actual shoe store in the city. On paper, we had a great deal. A guy in Atlanta was closing down his store and willing to sell us all his inventory for $10 a pair (in hindsight this was a terrible deal) for a minimum of $5,000.

We also designed our own shoe and handbag collection that we had made in China for a great deal. Yeah right!

Between the Atlanta deal, China and a few other store requirements we had a bill of $14,000. This would have been manageable, but we had not factored in shipping costs, shipping times and clearance costs.

How did we pay for the shipment? I had excellent credit and with it came a ton of 0% APR offers. We had all the misplaced confidence that once our delivery landed in Zimbabwe, we would be able to make HUGE profits. The shipment took too long to arrive, and by that time the 0% offers were expiring and that dreaded 24% APR was kicking in. That is the story of how we ended up with $33, 000 in debt.

Other people get into debt as they try to make ends meet. I have spoken to people borrowing to start-up projects as we did, pay tuition, care for a loved or spend on things they like but do not need.

Entrepreneurship

Entrepreneurship sounds sexy and fun, but the reality is a lot uglier. We made the mistake of falling for a good deal. If the business had been in the United States or any other place with a functioning economy, we could have borrowed our startup funds at a reasonable rate, and we would have insured the goods. Things do not always work this way in developing countries with precarious economic situations.

It is quite frightening that academics are suggesting that Africans can entrepreneur themselves out of poverty. Instead, most people are enterpreneuring themselves into debt. Most success stories do not detail the soft loan from wealthy parents or tax credits from governments that allow for the garage start-ups in the US and elsewhere.

It takes a long time for businesses to start making good & sustainable profits.

The truth is also that not everyone should be running a business. Like most people in the diaspora I have loaned friends and family money to start various projects and 8 out of 10 times the person is just not gifted in that area. The business is a waste of financial and time resources.

During the months I carried the debt I definitely felt like I was drowning. I was paying at least $800 a month to avoid being late on the cards, but the interest rates made it hard to make a dent. Our business was doing ok but keeping a business running required us to continue investing in more stock (or so we thought). I read Dave Ramsey’s snowball method and a lot of other books, but nothing was really working. I was still in graduate school earning less than $15,000 a year. I had a lot of expenses back home, school fees for my nephew and niece and other monthly obligations like groceries. The debt was stressing me. I was pulling from my savings to help pay the debt, but I was worried about being so far away from home with no safety net. I just needed to finish school and get a full-time job.

Finding a job is expensive. I invested in interview clothes, travel, resume assistance, thesis editing, and other interview prep help. I am glad it turned out ok, but I just want to emphasize that the cost of looking for a job is not $0. I wrote about this experience here.

Paying off $33k of debt in two years

I would not be writing this blog if the story did not end well. I am not going to make any fun GOT references. The heart of the story is that the same old personal finance principles apply. Live below your means, save 20% and pay off debt. I am going to attempt to show clear examples of how to do this. The summer after I finished my Ph.D., I took on a consulting job in Washington DC. I asked a friend if I could live in a tiny room in their apartment and pay about $200 for utilities. It was a perfect arrangement. I was able to pay off a personal loan and arrange for my husband’s move to the US as well as my own move later that summer to a new state for my job. We tend to get reimbursed after the semester has begun and I was not going to have a paycheck until September, so I needed to make sure I had funds to live on.

The numbers

That summer we also decided to start a new business. I know! Armed with lessons from seasons past we agreed that we would only invest $500. I am happy to report that the company is thriving.

To cut costs, I lived with my friend (Thank you, Ryan). I walked to work and carried my own lunch. In DC lunch expenses plus Saturday brunches can add up really quickly.

When we moved to my new job, we found a tiny one-bedroom apartment for $450 a month (all utilities included) it was a small space, but we never felt it. Maybe being newly married had something to do with our bliss. Our car was paid off. I bought it cash in grad school from a friend. We still have it (although we recently purchased a new car – more on that later). My job was in a small town with nothing much going on, so we splurged on Xfinity for $75 a month to get all our fav channels including HBO. We really like watching comedies, movies and of course GOT, Shameless, etc. Our total monthly expenses were $900 and came up to $1,500 with remittances.

After a few months at the new job, I researched options to deal with the interest. The only viable option was closing the cards and negotiating much lower interest rates.

Closing the major accounts was going to put a HUGE dent on my credit score. I struggled with this for a while, but when I spoke to someone from debt coach, they explained that if I closed the accounts and paid off my debt, I would end up with a better score. My high score at that point was meaningless is I was saddled with debt. So, I worked with them and closed four of my high balance accounts (there goes my 12-year history), and they helped me negotiate low-interest rates of 3% and 4%.

I finally had some breathing room. I could actually use the snowball method. At that point, the business could add another $500 to my $800 to pay off the debt.

BUT: Not everything went to debt

Retirement: More on this later but it is worth mentioning that my job had a 3% match, so I decided to set aside 3% each month towards retirement. If your employer has a match and you opt out, you are just throwing away free money. Or at least money that you are entitled to.

High Yield Savings account: I also opened a high yield savings account with American Express and was able to put in 10% to that account. More on this later

Emergency fund: we made sure that we had at least $3,000 in our emergency fund. Again- more on this later.

After setting aside small amounts, it was all debt. Notice that I went with % instead of real numbers to keep my goals manageable. I managed to do a few consulting jobs – all those earnings went to debt. Tax refunds went towards paying off debt.

I followed up on monies I had loaned friends and family, and all that “extra” income went to debt. In following up on loans, I lost friends and strained relationships. Money is not always good for building healthy relationships.

During those years we did not travel unless someone else was paying for the trip. We did not deny ourselves much because there was nothing to deny ourselves in our town. The one restaurant we liked had dinner for $8, and one can only eat the same meal so many times.

In future posts, I will try to break down some specific things that helped us reach our goal. The critical lesson for us was to live way below our means. I hope to never live in a shoebox again, but I am glad we were able to meet our goals during that season.

PRACTICAL STEP BY STEP TO PAY OFF DEBT

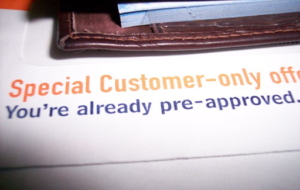

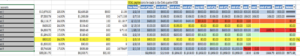

- Conduct an inventory of ALL your debt. List everything down including interest rates, due dates, and associated fees. List everything down. Include what you owe Sally from work, Auntie Mary and the IRS. It is scary, but it must be done even if the final number is $33 000

| Credit accounts |

Amount |

Interest rate |

Annual interest rate |

Personal set Minimum monthly |

months to pay |

| Account 1 |

$10,675.00 |

23.00% |

$2,455.25 |

$500 |

21.35 |

| Account 2 |

$7,355.79 |

14.50% |

$1,066.59 |

165 |

44.58054545 |

| Account 3 |

$2,119.17 |

24.00% |

$508.60 |

500 |

4.23834 |

| Account 4 |

$435.00 |

24.00% |

$104.40 |

200 |

2.175 |

| Account 5 |

$4,855.75 |

17.00% |

$825.48 |

|

|

| Account 6 |

$1,264.00 |

10.00% |

$126.40 |

200 |

6.32 |

| Account 7 |

$800.00 |

24.00% |

$192.00 |

100 |

8 |

| Account 8 |

$1,800.00 |

5.00% |

$90.00 |

100 |

18 |

| Account 9 |

$3,746.99 |

17.00% |

$636.99 |

202 |

18.54947525 |

|

$33,051.70 |

|

$6,005.71 |

$2,167 |

|

- When I did the inventory, my minimum monthly payments were about 40% of my gross salary. I decided on a monthly minimum that was double what the bank was asking for as part of our plan to pay the debt off sooner. After I closed four of the accounts the interest rates fell to 4% which was a lot manageable.

- How do you pay off using the snowball method?

- You start off with the smallest debt which was $800 in our case. After paying the minimum for each account, we threw anything extra to that account which actually allowed us to pay it off in a single month.

- After you have paid off the smallest account add payments from the account you just paid off to the next smallest debt.

- This is a much better method than focusing on interest rates.

- Cutting down expenses – as explained before – going over our budget with a total debt in mind allowed us actually to reduce our monthly costs. How do you do this?

- Reduce your housing cost – move into a smaller place if you need to

- Consider renting out your main home and moving into something smaller or having renters in one or two bedrooms.

- Cut down on any entertainment costs – the boredom will be a good motivator

- Live well below your means. There is always something to cut down.

- People might even have to eat rice beans for a couple of months or

- place kids in cheaper schools- I know! The horror – but it can be done

Paid off- Now what?

Dave Ramsey would tell you to cut up all your credit cards. He is not wrong. However, I would say let your real honest budget guide the way you live. I have a good friend in Zimbabwe (SHOUT OUT Massy) who has taught me a great deal about economic wisdom. She and her husband have excellent jobs, but instead of renting a fancy place in the nicer and more expensive parts of the city they built a small but really homey cottage on their plot just outside the city. They are now building the main house at their own pace- in the meantime, they live in their cute 2-bedroom house. She said when they bot their plot it was sold for $16,000. They had been renting a bigger house for $500 so when they did the math the plot was a much better investment.

My other friend is a mom of four. They live on one income to offset the cost of childcare in the diaspora. She makes all her meals at home (I have been begging her to start a blog). Her family eats well every day- I am a terrible cook, so I have no such aspirations. She manages to stay on budget by planning out her meals and buying deals. She also makes do with what she has- see picture below. I am sure there are great examples from people in your life or your own cases of adjusting things to make it work.

Follow her page on facebook for amazing recipes and tips to making yummy meals on a budget. Or just follow her because she is amazing and my friend

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Sep 2, 2019 | Money Professor

As you already know or now know, I am from Zimbabwe. Zim is an amazingly beautiful place, and the people are wonderful. However, we are mostly known now for our bad economy. The day I came to college, inflation was just hitting over 1000% -it was crazy. People lost all savings; retirement plans were voided, and most investments were wiped out. I was in high school then – things have not gotten much better as we have become adults, parents and in some cases, primary breadwinners.

It is hard to imagine that any good stories are coming out of Zim on finances. I am inspired by several people who have managed to survive during the last two decades. They are stressed a LOT, but I think we can all draw some inspiration from their stores.

Two teachers, two (then three) babies, chickens, and a home

I do not tell this particular woman often how much she inspires me. This is a story of a couple – they are both teachers in relatively low-income areas (Chi-Town). Neither comes from money. When I met them five years ago, they were paying $140 US rent for a couple of rooms in a shared home. The wife said to me that she had bought a stand and wanted to build. At the time their combined “formal” income was $800 US – today it is ZW$800 which is just under $200 US – inflation! Think compound interest in REVERSE!!!

Between 2013 and today here is what they have achieved and how (everything paid for in cash)

- Built a 3-bed home in a new development

- Taken the two oldest kids aged 8 and 13 to a better government school

- Had a 3rdbaby – C-section that became very costly due to complications missed during a regular scan

- Bought their first car and sold it for a more efficient used SUV

Their money strategies

- Moved out of rental after building the first two rooms on their stand to eliminate $140 in rent. That $140 added to their building fund

- Extra lessons and a second job – both teachers began offering private tutoring on weekends, and the husband took up a second job at a night school for adult learners. This move doubled their income

- The wife sold candy (she also sold shoes for my store on a small commission 10%)

- Organized a school carpool with other parents – this saved them 50% on transport costs

- A few years later moved one kid to a cheaper local school (they are heartbroken about this – any tips for them?)

- Ran a chicken business from their new home for a while (this required investing in a gas freezer and solar)

- The wife cut her hair (this made me super sad) she said she had been spending $70 monthly or so on her hair, so this has freed up some money

- Reduced maid service (this was a little rough with a little one at home, but she is doing nanny sharing with another family) which means she has to do all the house cleaning and laundry herself. Hand washing clothes is not fun for anyone

- Cut down on car use and relying on the new government buses which are only 0.50 but require that the husband leave home at 4:30 am EVERY WORKDAY!!!!!!

- Keeping it simple – but they have told me that the hardest thing is explaining to the babies why they can’t have small nice things. I am happy to report that as an experienced aunt (also available for hire) I am always happy to spoil the babies 🙂

- oh – they also said they avoid debt like a plague – they did get a loan through work in 2013 to start the house building but the interest was killing them

If you are surviving in a tough economy and have some tips to share please send them to me so that I can feature you on the blog. I would love love to hear from people taking nice vacations – how are you doing it? Ladies – get in formation

Aug 26, 2019 | Money Professor

This post is on thoughtful giving and things I learned from my mom

So maybe I am feeling a little sentimental because of some good things happening in our family, or perhaps it is that school is about to start. The start of school makes me happy for several reasons- the top of which is the arrival of international students in the US. I love getting to meet the students, especially those who have gone through a lot to find themselves here. My heart is filled with hope each time I learn of a young kid coming out of the refugee camps or a kid who has managed to live with very severe disabilities to make it to college. There are many inspiring stories. Common among them is the fact that the world is full of kind of people who donate in cash and in-kind to open doors for others.

I do not want us to become cynical about money. Yes, we must save and achieve whatever goals we set for ourselves, but we are not islands. Do not feel bad if you have more responsibilities than your peers. I think a lot about compound interest these days and I have thought that our big families and the villages we come from or build for ourselves are also a function of compound interest.

One of the things that shocked me the most when I first arrived in America was homelessness. It takes a lot for someone to end up homeless back home. Our families will rather sleep 20 people to a room than have a brother, a cousin, an uncle, or an aunt sleep on the streets.

There was a point when mom’s house was home to at least 15 adults, including an aunt, her husband, and two kids, my sister’s friend and her two kids and so on. I am always indebted to my sister, who made room for me at her home even when their home was already at full capacity with at least six teenage nephews and nieces from her husband’s side.

This is the core of who we are. I know there are many of you hosting new immigrants, friends who find themselves on the street for many reasons and still managing the demands from big families and the politics that come with that. Thank you. I am giving you a big hug.

What I do want us to continue thinking about is ways in which we balance our responsibilities and grow our money to build generational wealth. While we can’t plan for every emergency and hardship that the world throws our way, we can plan to mitigate the impact of bad things by planning.

Giving lessons from Chipo’s mom

- Never pay less than you can afford: There was a trader who sold tomatoes on our street. Amai Beauty was her name. She had four kids around my age. Whenever my mom returned from South Africa, she would bring clothes for her kids and some groceries, so naturally, Amai Beauty always offered my mom a discount on her veggies. My mom always politely declined. Mom explained to me that Mai Beauty needed every penny, and we did not need discounted tomatoes. Even though we had a lovely garden with tomatoes, veggies, corn, oranges (YES!!!), avocadoes (thanks Dad) mom would buy from Mai Beauty.

I get frustrated when I read of FIRE movement people who brag about free-riding on their friend’s Netflix account or always looking to get free yoga classes. People who seek out free yoga classes aggravate me. If you can afford to pay for Netflix or exchange a Netflix password for Hulu/amazon with your friend, then don’t be a douchebag. If you are saving a bunch of your income to grow a net worth of 2 million, you can very well pay $18 for a yoga class. Yoga teachers spend a ton of money on training, so trying to cheat them just to see your net worth numbers grow is an awful thing to do.

- Making giving a part of your lifestyle: My mom is a hopeless giver. Before I came to college, I told mom that one of my friends had a full scholarship, but she would likely miss out on school because of the $800 airfare. Mom sent the money. I would later learn that doing so wasn’t easy for her, but mom was adamant that a young girl should not miss out on education because of the cost of an air ticket. I am more like my dad. I try to be a bit more systematic in how I give. I believe that you can set aside a small % of your paycheck towards charitable giving and that % will grow as your income increases.

Think about what you value and give towards that.

- College giving, I am a beneficiary of generous scholarships from Linfield College. I feel very strongly about giving back – I know that my $20 a month is not worth much – to maximize my donation I itemized the gift and directed it towards a need that is often overlooked by big donors. I have asked that my donations be used to fund textbooks for a low-income international student.

- Tithing – I have not always been able to tithe, but now that I am working, I love being able to support our church activities. I honestly do not tithe 10% since I distribute my 10% giving allowance across my many passions. My church family is a central part of my life. A healthy church is a gift. I have also been very blessed to be a member of churches that support homeless shelters, food banks, and give scholarships.

- Supporting family- when I got to college, I decided to help my mom by taking over financial responsibility for a few family members. I chose to pay tuition and provide a food allowance. The need is always greater than I can afford, but I firmly believe that we need to send as many kids to school as we can.

- No money – no problem – other ways to give

My mom can be annoying when it comes to preaching about giving and doing for others. Mom says money is not the most significant gift. Every time we talk, mom is running from one volunteer activity to another.

- Time – I will never forget that my second Sunday in America (many may years ago) I showed up to the first Methodist church I found. My now host mom (had been host mom to a Zim student -my now adopted big sis-) asked if I could teach Sunday school. The Sunday school teacher had suddenly quit. I was happy to do it – what I did not know then was that children’s ministry never has enough volunteers, so I was stuck for four years lol. I didn’t mind. Every Sunday (and later Wednesday evenings) I committed 3 hours. Most parents are happy to have an hour of adult time, and they appreciate having a safe space to drop off their kids. I also learned a lot about America from the middle schoolers, so I was winning too.

- Habitat for humanity: our church ran a lot of HH programs. We built a ton of houses for low-income families. If you have a habitat for humanity in your town, I highly recommend getting involved. You will learn a lot and have a ton of fun. I also bonded with one of my host moms during our many trips to various homes. A decade-plus later she put together our pre-marriage guide -see you always win

- Leading volunteer trips- obviously I did not have money to pay for various excursions in college -duh – Zim inflation was in the billion trillion % at the time so yeah. But one free thing is being a team leader, or you pay a reduced rate. People hate leading trips because it is a lot of work! One of my best buddies and I led a trip to the Navajo valley and woow – what an experience. What an experience! I also interviewed for my Carter Center internship during that trip, and the hiring team loved the beat of the pow wow drums in the background lol -YOLO! I got the internship. That experience and that has opened to many doors in my life, including a weekend with President and Mrs. Carter for the husband and me a couple of years ago. I also made life long friends 🙂 our class had some of the best humans I have come to know and love.

- Random volunteer things- try to give in ways that make you happy. Trust me – it is always worth it.

In summary

- Never ask for a discount from someone who needs the money when you can afford to pay full price

- Make financial giving a central part of your budget even if it is a small amount. If you are not sure of where to send money may I suggest

- The USAP school https://usapschool.org-also read their NYTimes feature here

- Local churches especially ones with a homeless shelter program and or a food bank

- Family members who need a financial boost

- Paying tuition for as many little boys and girls as you can

- Your alma mater

- Give your time – financial giving is just a small part of your giving life

- Instead of asking for a discount for services ask if you can exchange labor for a class

- Habitat for humanity

- Leading volunteer trips

- Children’s ministry

- Set up and breakdown at events

- Tutoring

- Big Brother Big Sister programs

- Food Bank – they always need people to clean up, organize the food and do deliveries

This week’s TV show suggestions because YOLO

Peaky Blinders

Into the badlands

Family Reunion on Netflix

Glow on Netflix

The funny or not funny JAniston and Adam Sandler movie

Four Weddings and A Funeral on Hulu

I am worried about my TV choices

Aug 19, 2019 | Money Professor

Emergencies -Yikes

Most financial gurus advise that you should have an emergency fund of at least six months of expenses. This is really good advice. However, I feel like the emergencies are expected to stop while I build my fund. As if there is a pause button that we can press then click resume when we are all saved up.

Maybe it is just me, but sometimes it does feel like the emergencies pop up every month, every week or sometimes every day. I am not thinking about black tax which I write about here because fixed bills are something that we can plan and budget for.

For those of us from communities where we are expected to help out family and friends, this means that we are continually responding not just to our emergencies but those of our family members and there we have a lot less control.

For our households we can put several protections in place like

- Car insurance to cover you in case of an emergency

- Health insurance and the various FSA/HAS plans for health care emergencies

- Life insurance

- Short- or long-term disability

If we get sick (knock on wood) we will most likely not go bankrupt. If we are in a car fender bender, we are covered, but this is not the case for our families back home. For most of us in the diaspora or if you are the one earning a little bit more, you are the emergency fund.

There are no safety nets in most African countries – maybe I can speak to the Zimbabwean experience, but I know this is true for friends in Ghana, Nigeria, Kenya, etc. I read a recent blog post that said when you return home to the continent be prepared to be your own state providing electricity, clean water, and I would even add sometimes managing road construction.

The hard thing is that a lot of the emergencies that find their way into our phones are real emergencies. People get sick; people are in accidents (thanks to poor infrastructure and overcrowded taxis), parents are asked to top up tuition because the economy sucks. Someone finds themselves with a considerable shortfall for a life-changing opportunity because the economy tanked.

Let us list some acceptable emergencies for you to agonize over

- Health –

- Death – death is terrible and often unexpected even when it is it is honestly a crappy thing to deal with

- A home disaster like a fire or flooding – even in cases where one has good insurance payouts take a long time to come. This is just a terrible situation to find oneself in

- Job loss in a crappy economy

It is important that we also clarify things that do not count as emergencies for which you should feel 0% guilt for saying no to. Say no for any of these requests that come with a 48-hour window for your response.

- Wedding contributions- I will give a wedding gift, but I will not contribute to solicited requests for group funding. No one is required to get married. Literally no one.

- Tuition – for the child or the parents. Seriously, my mother was a cross-boarder trader who paid my tuition. No-school fees is not a surprise except if a parent dies, then I think God calls on us to support orphans.

-

Trips – what is with all these never-ending church trips? If papa prophet wants you to take a trip, then he should pay for it. If you cannot pay for a trip, then it is not in your spiritual path to go on the trip.

- Baby things – I will buy a gift, but parents have nine months to prepare for a child unless the ask is for health-related matters then yes! Agonize and pray over this. We do not want babies to suffer.

- Fixing a broken car – yeah no

- Home improvement – def say no. Also, if you do not own a home, you have no business involving yourself in people’s home projects.

- Insert yours here

Of course, these are my lists. Even with these lists, I still agonize over the asks that come my way. The reason you need to have a list is so that you can quickly decide if the request is something you should stress over, especially when funds are tight. Do not take any debt to cover the non-emergency list because that is not a smart thing to do.

How do we budget for emergencies that are not ours?

- Set aside 10% of your income forgiving. It is your choice if you do so before or after tax. If you are in a position to give, please do give. It is very good for your mental health.

- Distribute your giving income between areas that you value – for me; it is church and family/friend emergencies.

- If you lose a parent or your parent is not well, you also have the option to borrow from you Roth, but this is the last resort. If it is within your means, get health insurance for the parents and some life policy.

How do we work towards saying no?

- This is hard, and there are no easy answers

- Write your $0 budget. If you do not have the money, you will not be lying if you say no

- Be honest with people on why you are not able to help at that moment

- If the above does not work, then make a list of who you can turn to in an emergency – if the list is blank then you really need to save up for that emergency fund.

Discussion