The average individual in America has at least $5, 331 in credit card debt and many of them are unable to pay it. A lot of people carry debt from student loans. I was way above average. Being above average is really good but not in this particular circumstance. At its worst, my debt was $33, 051.70. Yep! I was keeping track of the cents. People in developing countries are not doing much better either on dealing with debt. Banks are predatory. I shudder every time I read something on the wonders of mobile money that does not address how easy it has become to get loans that have a ridiculously high interest rate and a very short payback period. In Zimbabwe, the average person is struggling to make ends meet as salaries fall way behind the rapidly increasing cost of essential commodities. And yet, banks are making healthy profits because they routinely partner with employers to offer loans with interest rates of over 20% in many cases. In Kenya, personal debt is also crippling with a national income to debt ratio of over 60%.In South Africa, people can buy groceries on credit. The national personal debt is over $15.1 bn USD. Only the banks benefit, but there are things we can all do to manage debt, get out of it and stay out of it.

The back story

So how does someone with excellent credit, no student loans, and reasonable budget skills end up in such a pit? Good deals! There is always a good deal, and if we are not careful, we can follow it right into the hole of fire. In this particular case, my business partner and I saw an opportunity to expand our business from “trunk of our car” to an actual shoe store in the city. On paper, we had a great deal. A guy in Atlanta was closing down his store and willing to sell us all his inventory for $10 a pair (in hindsight this was a terrible deal) for a minimum of $5,000.

We also designed our own shoe and handbag collection that we had made in China for a great deal. Yeah right!

Between the Atlanta deal, China and a few other store requirements we had a bill of $14,000. This would have been manageable, but we had not factored in shipping costs, shipping times and clearance costs.

How did we pay for the shipment? I had excellent credit and with it came a ton of 0% APR offers. We had all the misplaced confidence that once our delivery landed in Zimbabwe, we would be able to make HUGE profits. The shipment took too long to arrive, and by that time the 0% offers were expiring and that dreaded 24% APR was kicking in. That is the story of how we ended up with $33, 000 in debt.

Other people get into debt as they try to make ends meet. I have spoken to people borrowing to start-up projects as we did, pay tuition, care for a loved or spend on things they like but do not need.

Entrepreneurship

Entrepreneurship sounds sexy and fun, but the reality is a lot uglier. We made the mistake of falling for a good deal. If the business had been in the United States or any other place with a functioning economy, we could have borrowed our startup funds at a reasonable rate, and we would have insured the goods. Things do not always work this way in developing countries with precarious economic situations.

It is quite frightening that academics are suggesting that Africans can entrepreneur themselves out of poverty. Instead, most people are enterpreneuring themselves into debt. Most success stories do not detail the soft loan from wealthy parents or tax credits from governments that allow for the garage start-ups in the US and elsewhere.

It takes a long time for businesses to start making good & sustainable profits.

The truth is also that not everyone should be running a business. Like most people in the diaspora I have loaned friends and family money to start various projects and 8 out of 10 times the person is just not gifted in that area. The business is a waste of financial and time resources.

During the months I carried the debt I definitely felt like I was drowning. I was paying at least $800 a month to avoid being late on the cards, but the interest rates made it hard to make a dent. Our business was doing ok but keeping a business running required us to continue investing in more stock (or so we thought). I read Dave Ramsey’s snowball method and a lot of other books, but nothing was really working. I was still in graduate school earning less than $15,000 a year. I had a lot of expenses back home, school fees for my nephew and niece and other monthly obligations like groceries. The debt was stressing me. I was pulling from my savings to help pay the debt, but I was worried about being so far away from home with no safety net. I just needed to finish school and get a full-time job.

Finding a job is expensive. I invested in interview clothes, travel, resume assistance, thesis editing, and other interview prep help. I am glad it turned out ok, but I just want to emphasize that the cost of looking for a job is not $0. I wrote about this experience here.

Paying off $33k of debt in two years

I would not be writing this blog if the story did not end well. I am not going to make any fun GOT references. The heart of the story is that the same old personal finance principles apply. Live below your means, save 20% and pay off debt. I am going to attempt to show clear examples of how to do this. The summer after I finished my Ph.D., I took on a consulting job in Washington DC. I asked a friend if I could live in a tiny room in their apartment and pay about $200 for utilities. It was a perfect arrangement. I was able to pay off a personal loan and arrange for my husband’s move to the US as well as my own move later that summer to a new state for my job. We tend to get reimbursed after the semester has begun and I was not going to have a paycheck until September, so I needed to make sure I had funds to live on.

The numbers

That summer we also decided to start a new business. I know! Armed with lessons from seasons past we agreed that we would only invest $500. I am happy to report that the company is thriving.

To cut costs, I lived with my friend (Thank you, Ryan). I walked to work and carried my own lunch. In DC lunch expenses plus Saturday brunches can add up really quickly.

When we moved to my new job, we found a tiny one-bedroom apartment for $450 a month (all utilities included) it was a small space, but we never felt it. Maybe being newly married had something to do with our bliss. Our car was paid off. I bought it cash in grad school from a friend. We still have it (although we recently purchased a new car – more on that later). My job was in a small town with nothing much going on, so we splurged on Xfinity for $75 a month to get all our fav channels including HBO. We really like watching comedies, movies and of course GOT, Shameless, etc. Our total monthly expenses were $900 and came up to $1,500 with remittances.

After a few months at the new job, I researched options to deal with the interest. The only viable option was closing the cards and negotiating much lower interest rates.

Closing the major accounts was going to put a HUGE dent on my credit score. I struggled with this for a while, but when I spoke to someone from debt coach, they explained that if I closed the accounts and paid off my debt, I would end up with a better score. My high score at that point was meaningless is I was saddled with debt. So, I worked with them and closed four of my high balance accounts (there goes my 12-year history), and they helped me negotiate low-interest rates of 3% and 4%.

I finally had some breathing room. I could actually use the snowball method. At that point, the business could add another $500 to my $800 to pay off the debt.

BUT: Not everything went to debt

Retirement: More on this later but it is worth mentioning that my job had a 3% match, so I decided to set aside 3% each month towards retirement. If your employer has a match and you opt out, you are just throwing away free money. Or at least money that you are entitled to.

High Yield Savings account: I also opened a high yield savings account with American Express and was able to put in 10% to that account. More on this later

Emergency fund: we made sure that we had at least $3,000 in our emergency fund. Again- more on this later.

After setting aside small amounts, it was all debt. Notice that I went with % instead of real numbers to keep my goals manageable. I managed to do a few consulting jobs – all those earnings went to debt. Tax refunds went towards paying off debt.

I followed up on monies I had loaned friends and family, and all that “extra” income went to debt. In following up on loans, I lost friends and strained relationships. Money is not always good for building healthy relationships.

During those years we did not travel unless someone else was paying for the trip. We did not deny ourselves much because there was nothing to deny ourselves in our town. The one restaurant we liked had dinner for $8, and one can only eat the same meal so many times.

In future posts, I will try to break down some specific things that helped us reach our goal. The critical lesson for us was to live way below our means. I hope to never live in a shoebox again, but I am glad we were able to meet our goals during that season.

PRACTICAL STEP BY STEP TO PAY OFF DEBT

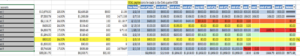

- Conduct an inventory of ALL your debt. List everything down including interest rates, due dates, and associated fees. List everything down. Include what you owe Sally from work, Auntie Mary and the IRS. It is scary, but it must be done even if the final number is $33 000

| Credit accounts | Amount | Interest rate | Annual interest rate | Personal set Minimum monthly | months to pay |

| Account 1 | $10,675.00 | 23.00% | $2,455.25 | $500 | 21.35 |

| Account 2 | $7,355.79 | 14.50% | $1,066.59 | 165 | 44.58054545 |

| Account 3 | $2,119.17 | 24.00% | $508.60 | 500 | 4.23834 |

| Account 4 | $435.00 | 24.00% | $104.40 | 200 | 2.175 |

| Account 5 | $4,855.75 | 17.00% | $825.48 | ||

| Account 6 | $1,264.00 | 10.00% | $126.40 | 200 | 6.32 |

| Account 7 | $800.00 | 24.00% | $192.00 | 100 | 8 |

| Account 8 | $1,800.00 | 5.00% | $90.00 | 100 | 18 |

| Account 9 | $3,746.99 | 17.00% | $636.99 | 202 | 18.54947525 |

| $33,051.70 | $6,005.71 | $2,167 |

- When I did the inventory, my minimum monthly payments were about 40% of my gross salary. I decided on a monthly minimum that was double what the bank was asking for as part of our plan to pay the debt off sooner. After I closed four of the accounts the interest rates fell to 4% which was a lot manageable.

- How do you pay off using the snowball method?

- You start off with the smallest debt which was $800 in our case. After paying the minimum for each account, we threw anything extra to that account which actually allowed us to pay it off in a single month.

- After you have paid off the smallest account add payments from the account you just paid off to the next smallest debt.

- This is a much better method than focusing on interest rates.

- Cutting down expenses – as explained before – going over our budget with a total debt in mind allowed us actually to reduce our monthly costs. How do you do this?

- Reduce your housing cost – move into a smaller place if you need to

- Consider renting out your main home and moving into something smaller or having renters in one or two bedrooms.

- Cut down on any entertainment costs – the boredom will be a good motivator

- Live well below your means. There is always something to cut down.

- People might even have to eat rice beans for a couple of months or

- place kids in cheaper schools- I know! The horror – but it can be done

- People might even have to eat rice beans for a couple of months or

- Reduce your housing cost – move into a smaller place if you need to

Paid off- Now what?

Dave Ramsey would tell you to cut up all your credit cards. He is not wrong. However, I would say let your real honest budget guide the way you live. I have a good friend in Zimbabwe (SHOUT OUT Massy) who has taught me a great deal about economic wisdom. She and her husband have excellent jobs, but instead of renting a fancy place in the nicer and more expensive parts of the city they built a small but really homey cottage on their plot just outside the city. They are now building the main house at their own pace- in the meantime, they live in their cute 2-bedroom house. She said when they bot their plot it was sold for $16,000. They had been renting a bigger house for $500 so when they did the math the plot was a much better investment.

My other friend is a mom of four. They live on one income to offset the cost of childcare in the diaspora. She makes all her meals at home (I have been begging her to start a blog). Her family eats well every day- I am a terrible cook, so I have no such aspirations. She manages to stay on budget by planning out her meals and buying deals. She also makes do with what she has- see picture below. I am sure there are great examples from people in your life or your own cases of adjusting things to make it work.

Follow her page on facebook for amazing recipes and tips to making yummy meals on a budget. Or just follow her because she is amazing and my friend

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Discussion