CREDIT CARDS

Pic from bankrate.com

Disclaimer: Not a financial advisor – just sharing my thoughts

So, credit cards- so much to think about.

This first post is for those who want to learn how to read their statement. The next post will be on the benefits and advantages of using credit cards.

Do you know how to read your credit card statement? There is no shame in not knowing how. It took me years to fully understand how credit cards work.

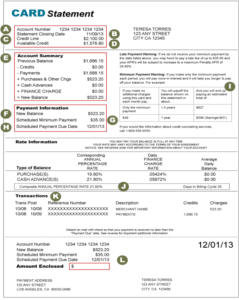

Figure 1: credit statement from handsonbanking.com

- Your account number -do not share this with anyone

- Statement Closing-The day the bank created the statement-this also determines how much you need to pay for the month

- Credit line- This is your spending limit. How much you can borrow

- Available Credit- how much loan access you have to.

- ACCOUNT SUMMARY – activities on your account.

- Previous Balance- What you owed in the last month

- Payments -what you paid towards the previous balance

- Purchases and other charges – if you bought anything this month the amount will charge here

- Cash advances- Try and avoid these – this is when you get actual cash from the credit card. The interest is a lot more. You do

- Finance Charge- interest charged if you did not make payments toward previous balance or if you made a partial payment

- New Balance- if you did not carry over a balance from last month and did not make any other payments your balance should be = purchases and other charges

- New Balance – What you owe this month

- Minimum Payment- This is the least that you should pay each month to avoid penalties. You can pay more -highly advisable to pay more or all of your balance.

- Scheduled Payment Due Date – This is the final day for you to pay your bill (F). If you do not make a payment, you will get hit by LATE FEES + INTEREST + WHATEVER ELSE THEY WANT

- MINIMUM WARNING- Banks are required by law to inform you how long it will take you to pay off your credit card if you just pay the minimum and how much it will cost you.

- Rate Information: How your fees and interests are calculated- IMPORTANT –most cards can start with a promotional rate -say 0% for 12 months. If you make late payments, you can lose that. After the year is over the rate might increase to something like 24%. They also have different rates for purchases and cash advance with CA always having a high rate.

- Transactions- the list of purchases and payments you made. Double-check that you are only being charged for what you spent on.

- Payment coupon -repeats all the payment information

Discussion