Apr 30, 2019 | Money Professor

I am really glad that during tough times my friends have bailed me out and that I have done the same for them. My mom and my wonderfully big village of mentors have also been really great at supporting me financially during big transitions like our wedding and pampering us as needed. I want to say this right off the bet to show that I value giving and getting help.

As with credit cards, friends and family loans can be really helpful if used correctly. Unfortunately, as with credit cards, the system is really easy to abuse. A good Samaritan move can easily become a headache and a once strong relationship can become strained.

During graduate school, I was able to save quite a bit of money by working in university housing. That job was a life saver. The job came with “free” housing – in quotes because we worked hard for every bit of that housing. It was really nice to live in rent-free housing for three years. After those three years, I had over $10, 000 in my savings account. Yay me

My problem as one friend has repeatedly told me is that I really like helping out. Some people might say I like fixing problems that have nothing to do with me. I do not think this is a necessarily bad trait. The challenge is that when I was younger, I did not know how to manage this gift.

In a single year, I loaned out over $8,000 to friends and family for various projects that had nothing to do with me. One friend wanted money for her husband to travel to Europe for his graduation. At 26 years old I was loaning over $3k to a 40 something-year-old homeowner to travel all the way from Zimbabwe to Europe for his Ph.D. graduation. I know what it sounds like and I agree. Dah! That was really dumb- that friendship ended in flames. It was a really ugly break up because when I asked for my money back my friend switched topics and called me a word that I can’t write here – yep. It went there.

I also loaned money to a few close relatives who were engaged in a number of projects including house building. I did get back some the money over time, but we had major disagreements over how much I was actually owed. I probably hadn’t done a really good job of keeping track of my expenses. Funny thing- I do not have a house or a brick to my name. The joke is on who??? A running joke between my mom and me is that I no longer loan money to folks with title deeds. Another relative was what I have termed a revolving borrower. They were really good at paying back on time but in a week or so they would be back asking for another loan. Since I was suffering from idle money it was way too easy to loan them money.

One expense I do not regret but could have managed better was contributing to a family fund for a close relative who was very ill. Family emergencies should not drain you financially. There are strategies to plan ahead that we can discuss and brainstorm.

Teamwork makes the dream work but only if there is a clear dream.

DO NOT HAVE IDLE MONEY!!!!

It is important to set short- and long-term goals for yourself. My problem at that time is that I was just saving without any serious framework for what I was saving for. My major expenses -rent, food, and tuition where taken care of which made me a little complacent. I was young and not really thinking about buying a house because I had no idea where I was going to settle after grad school. Idleness is bad for your money and bad for your future. When friends and family asked for money, of course, I said yes because I had the money and I assumed that they would pay it back. I did not account for unforeseen events that might prevent even the most well-meaning person to pay back.

ALWAYS HAVE A 5 YEAR PLAN

Always and I mean always have a clear five-year plan for yourself. The actual plan does not need to be financial, but you can calculate the costs associated with your general life aspirations and transitions from stage to the next.

For example, if you are an international college or graduate student in the US the fact is that in 3 or four years you will graduate. As an international student, you will need to pay for OPT. The cost has gone up from just under $100 when I was a student to $400. You will want to go home for a visit or invite parents to graduation either one or both of those expenses will cost you upwards of $2500. You will need a place to move into after you graduate and, in most cases, you will need to pay a security deposit plus first months rent. You may move to a city that will require that you drive. These are not major goals, but you can see how quickly the costs add up. If you are now an adult, you already know how quickly the simple act of living can add up into major expenses. Try to avoid emergency situations by planning for basic things.

So how do we avoid loaning friends and family?

Ok- so in the American culture family loan contracts are a thing and they work but for most African cultures this will not work. So, your default will have to be no. No is a complete sentence. I know – I am saying this to my amazing friends who have in the past bailed me out (you should have said nooooo). The default (unless someone is dying _ which we should also talk about -life policies and health insurance are a thing- use them) should be a sweet NO.

Because we are kind people, saying no is really hard. However, if you do not have idle money then you are not actually saying no because all your money is planned for. Recently, a friend asked me for a substantial amount for a good reason but since we are praying about our future with 10 kids, I do not have extra money because growing up is expensive. I was able to say no without ruining a good friendship or feeling guilty about it. I even jokingly (no seriously) asked if they wanted to contribute to the goal.

Chipo, are you saying we can’t help our friends and family?

Of course, we can. Establish if the “right” help is money. Let us circle back to my friend who wanted to pay for her husband’s ticket to attend his graduation. There were a few options that we could have explored and in doing so we would have saved what was a really sweet friendship.

- If it was absolutely necessary for him to attend the event they could have borrowed from a bank or used their credit cards.

- Not attending graduation that year was also a viable option. For example, after my doctorate, I delayed graduation by a year. I know many other friends who have used this option.

A small Zimbabwe (extended family) fund

Over the years I have also developed a small SOS fund. We put in $20 a month. I only take from this fund to contribute to various family and friendship needs. Per month I get at an average of 5 financial requests. I have actually kept an excel document to track them over time. Some requests like can you pay for some church trip are a hard no- I do not even attend fun trips I want to go on so that is a hard pass. Can you help me pay kid’s tuition– that one requires additional questioning because tuition is not a random event. From the moment a baby is born it is a fact that they will need tuition, so it really depends. I have two kids I pay tuition for and I plan months in advance for that – even when I had my huge debt to contend with. So depending on the circumstance I really evaluate how much I can contribute but in most cases, my share is never more than 10% of the required amount. This is also the type of money I do not expect to get back, so it is charitable giving.

Health-related contributions

Back home, our healthcare sucks so inevitably family will need support. We can’t put a $ value on health. We can, however, encourage family (those who are able) to take out small health insurance plans. I was so proud of my little sister – her monthly salary is only $600 USD but she has a health plan for herself and the parents (we are cousins) along with a funeral policy. In total, she spends about $100 on these plans for herself and four others. When she got sick a while back the plan covered over $800 in treatment costs for her. (God job mainini – I love you!) When my uncle passed on recently, I was really impressed by the way the funeral policy company handled all the details. Kudos to Nyaradzo funeral policy. Since many of us had just assumed that we would help fund the funeral the family ended up with a lot of extra food that they were able to donate to relatives who needed the help.

Family weddings

Family weddings – when we got married, we avoided asking for contributions because- again a wedding is not an EMERGENCY. We (mostly me) decided on a fancy wedding near the water so we paid for it (thank you, mama, and adopted parents for chipping in). This also extended to my bridesmaids’ dresses. Why should I expect folks to pay for a navy-blue dress that they will only wear once – granted our dresses were actually cute but still. If folks can’t afford a big wedding the court option is very much viable. However, I do love gifting so I will always happily give a gift and if it is someone important to me, I break some rules and chip in. That just means I take away from another budget item. With so many friends getting married we actually have a small wedding fund to cover travel, gifts and last-minute chip in.

Are you a bank?

Basically, you are not a bank so you really must avoid giving out loans. You should also plan your life and that way you can avoid complicated questions. Idle money is bad for your health and relationships. So, by planning you are actually working towards healthier relationships. In addition to an emergency fund, you will need a few other funds related to your Africaness to keep your sanity. When we discuss remittances I will tell you something one of my very smart lady friends told me. She went to MIT and has a Ph.D. in engineering so you should probably take her advice (Love you Loloz).

Apr 30, 2019 | Money Professor

The average individual in America has at least $5, 331 in credit card debt and many of them are unable to pay it. A lot of people carry debt from student loans. I was way above average. Being above average is really good but not in this particular circumstance. At its worst, my debt was $33, 051.70. Yep! I was keeping track of the cents. People in developing countries are not doing much better either on dealing with debt. Banks are predatory. I shudder every time I read something on the wonders of mobile money that does not address how easy it has become to get loans that have a ridiculously high interest rate and a very short payback period. In Zimbabwe, the average person is struggling to make ends meet as salaries fall way behind the rapidly increasing cost of essential commodities. And yet, banks are making healthy profits because they routinely partner with employers to offer loans with interest rates of over 20% in many cases. In Kenya, personal debt is also crippling with a national income to debt ratio of over 60%.In South Africa, people can buy groceries on credit. The national personal debt is over $15.1 bn USD. Only the banks benefit, but there are things we can all do to manage debt, get out of it and stay out of it.

The back story

So how does someone with excellent credit, no student loans, and reasonable budget skills end up in such a pit? Good deals! There is always a good deal, and if we are not careful, we can follow it right into the hole of fire. In this particular case, my business partner and I saw an opportunity to expand our business from “trunk of our car” to an actual shoe store in the city. On paper, we had a great deal. A guy in Atlanta was closing down his store and willing to sell us all his inventory for $10 a pair (in hindsight this was a terrible deal) for a minimum of $5,000.

We also designed our own shoe and handbag collection that we had made in China for a great deal. Yeah right!

Between the Atlanta deal, China and a few other store requirements we had a bill of $14,000. This would have been manageable, but we had not factored in shipping costs, shipping times and clearance costs.

How did we pay for the shipment? I had excellent credit and with it came a ton of 0% APR offers. We had all the misplaced confidence that once our delivery landed in Zimbabwe, we would be able to make HUGE profits. The shipment took too long to arrive, and by that time the 0% offers were expiring and that dreaded 24% APR was kicking in. That is the story of how we ended up with $33, 000 in debt.

Other people get into debt as they try to make ends meet. I have spoken to people borrowing to start-up projects as we did, pay tuition, care for a loved or spend on things they like but do not need.

Entrepreneurship

Entrepreneurship sounds sexy and fun, but the reality is a lot uglier. We made the mistake of falling for a good deal. If the business had been in the United States or any other place with a functioning economy, we could have borrowed our startup funds at a reasonable rate, and we would have insured the goods. Things do not always work this way in developing countries with precarious economic situations.

It is quite frightening that academics are suggesting that Africans can entrepreneur themselves out of poverty. Instead, most people are enterpreneuring themselves into debt. Most success stories do not detail the soft loan from wealthy parents or tax credits from governments that allow for the garage start-ups in the US and elsewhere.

It takes a long time for businesses to start making good & sustainable profits.

The truth is also that not everyone should be running a business. Like most people in the diaspora I have loaned friends and family money to start various projects and 8 out of 10 times the person is just not gifted in that area. The business is a waste of financial and time resources.

During the months I carried the debt I definitely felt like I was drowning. I was paying at least $800 a month to avoid being late on the cards, but the interest rates made it hard to make a dent. Our business was doing ok but keeping a business running required us to continue investing in more stock (or so we thought). I read Dave Ramsey’s snowball method and a lot of other books, but nothing was really working. I was still in graduate school earning less than $15,000 a year. I had a lot of expenses back home, school fees for my nephew and niece and other monthly obligations like groceries. The debt was stressing me. I was pulling from my savings to help pay the debt, but I was worried about being so far away from home with no safety net. I just needed to finish school and get a full-time job.

Finding a job is expensive. I invested in interview clothes, travel, resume assistance, thesis editing, and other interview prep help. I am glad it turned out ok, but I just want to emphasize that the cost of looking for a job is not $0. I wrote about this experience here.

Paying off $33k of debt in two years

I would not be writing this blog if the story did not end well. I am not going to make any fun GOT references. The heart of the story is that the same old personal finance principles apply. Live below your means, save 20% and pay off debt. I am going to attempt to show clear examples of how to do this. The summer after I finished my Ph.D., I took on a consulting job in Washington DC. I asked a friend if I could live in a tiny room in their apartment and pay about $200 for utilities. It was a perfect arrangement. I was able to pay off a personal loan and arrange for my husband’s move to the US as well as my own move later that summer to a new state for my job. We tend to get reimbursed after the semester has begun and I was not going to have a paycheck until September, so I needed to make sure I had funds to live on.

The numbers

That summer we also decided to start a new business. I know! Armed with lessons from seasons past we agreed that we would only invest $500. I am happy to report that the company is thriving.

To cut costs, I lived with my friend (Thank you, Ryan). I walked to work and carried my own lunch. In DC lunch expenses plus Saturday brunches can add up really quickly.

When we moved to my new job, we found a tiny one-bedroom apartment for $450 a month (all utilities included) it was a small space, but we never felt it. Maybe being newly married had something to do with our bliss. Our car was paid off. I bought it cash in grad school from a friend. We still have it (although we recently purchased a new car – more on that later). My job was in a small town with nothing much going on, so we splurged on Xfinity for $75 a month to get all our fav channels including HBO. We really like watching comedies, movies and of course GOT, Shameless, etc. Our total monthly expenses were $900 and came up to $1,500 with remittances.

After a few months at the new job, I researched options to deal with the interest. The only viable option was closing the cards and negotiating much lower interest rates.

Closing the major accounts was going to put a HUGE dent on my credit score. I struggled with this for a while, but when I spoke to someone from debt coach, they explained that if I closed the accounts and paid off my debt, I would end up with a better score. My high score at that point was meaningless is I was saddled with debt. So, I worked with them and closed four of my high balance accounts (there goes my 12-year history), and they helped me negotiate low-interest rates of 3% and 4%.

I finally had some breathing room. I could actually use the snowball method. At that point, the business could add another $500 to my $800 to pay off the debt.

BUT: Not everything went to debt

Retirement: More on this later but it is worth mentioning that my job had a 3% match, so I decided to set aside 3% each month towards retirement. If your employer has a match and you opt out, you are just throwing away free money. Or at least money that you are entitled to.

High Yield Savings account: I also opened a high yield savings account with American Express and was able to put in 10% to that account. More on this later

Emergency fund: we made sure that we had at least $3,000 in our emergency fund. Again- more on this later.

After setting aside small amounts, it was all debt. Notice that I went with % instead of real numbers to keep my goals manageable. I managed to do a few consulting jobs – all those earnings went to debt. Tax refunds went towards paying off debt.

I followed up on monies I had loaned friends and family, and all that “extra” income went to debt. In following up on loans, I lost friends and strained relationships. Money is not always good for building healthy relationships.

During those years we did not travel unless someone else was paying for the trip. We did not deny ourselves much because there was nothing to deny ourselves in our town. The one restaurant we liked had dinner for $8, and one can only eat the same meal so many times.

In future posts, I will try to break down some specific things that helped us reach our goal. The critical lesson for us was to live way below our means. I hope to never live in a shoebox again, but I am glad we were able to meet our goals during that season.

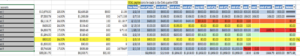

PRACTICAL STEP BY STEP TO PAY OFF DEBT

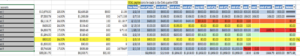

- Conduct an inventory of ALL your debt. List everything down including interest rates, due dates, and associated fees. List everything down. Include what you owe Sally from work, Auntie Mary and the IRS. It is scary, but it must be done even if the final number is $33 000

| Credit accounts |

Amount |

Interest rate |

Annual interest rate |

Personal set Minimum monthly |

months to pay |

| Account 1 |

$10,675.00 |

23.00% |

$2,455.25 |

$500 |

21.35 |

| Account 2 |

$7,355.79 |

14.50% |

$1,066.59 |

165 |

44.58054545 |

| Account 3 |

$2,119.17 |

24.00% |

$508.60 |

500 |

4.23834 |

| Account 4 |

$435.00 |

24.00% |

$104.40 |

200 |

2.175 |

| Account 5 |

$4,855.75 |

17.00% |

$825.48 |

|

|

| Account 6 |

$1,264.00 |

10.00% |

$126.40 |

200 |

6.32 |

| Account 7 |

$800.00 |

24.00% |

$192.00 |

100 |

8 |

| Account 8 |

$1,800.00 |

5.00% |

$90.00 |

100 |

18 |

| Account 9 |

$3,746.99 |

17.00% |

$636.99 |

202 |

18.54947525 |

|

$33,051.70 |

|

$6,005.71 |

$2,167 |

|

- When I did the inventory, my minimum monthly payments were about 40% of my gross salary. I decided on a monthly minimum that was double what the bank was asking for as part of our plan to pay the debt off sooner. After I closed four of the accounts the interest rates fell to 4% which was a lot manageable.

- How do you pay off using the snowball method?

- You start off with the smallest debt which was $800 in our case. After paying the minimum for each account, we threw anything extra to that account which actually allowed us to pay it off in a single month.

- After you have paid off the smallest account add payments from the account you just paid off to the next smallest debt.

- This is a much better method than focusing on interest rates.

- Cutting down expenses – as explained before – going over our budget with a total debt in mind allowed us actually to reduce our monthly costs. How do you do this?

- Reduce your housing cost – move into a smaller place if you need to

- Consider renting out your main home and moving into something smaller or having renters in one or two bedrooms.

- Cut down on any entertainment costs – the boredom will be a good motivator

- Live well below your means. There is always something to cut down.

- People might even have to eat rice beans for a couple of months or

- place kids in cheaper schools- I know! The horror – but it can be done

Paid off- Now what?

Dave Ramsey would tell you to cut up all your credit cards. He is not wrong. However, I would say let your real honest budget guide the way you live. I have a good friend in Zimbabwe (SHOUT OUT Massy) who has taught me a great deal about economic wisdom. She and her husband have excellent jobs, but instead of renting a fancy place in the nicer and more expensive parts of the city they built a small but really homey cottage on their plot just outside the city. They are now building the main house at their own pace- in the meantime, they live in their cute 2-bedroom house. She said when they bot their plot it was sold for $16,000. They had been renting a bigger house for $500 so when they did the math the plot was a much better investment.

My other friend is a mom of four. They live on one income to offset the cost of childcare in the diaspora. She makes all her meals at home (I have been begging her to start a blog). Her family eats well every day- I am a terrible cook, so I have no such aspirations. She manages to stay on budget by planning out her meals and buying deals. She also makes do with what she has- see picture below. I am sure there are great examples from people in your life or your own cases of adjusting things to make it work.

Follow her page on facebook for amazing recipes and tips to making yummy meals on a budget. Or just follow her because she is amazing and my friend

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Apr 30, 2019 | Money Professor

I love that a lot of my friends are brilliant and well-educated women. Girls Rock!

When I first started thinking about personal finance, I asked my girlfriends if they had a budget. The popular answer was “kind of.” Some said they felt that a budget was useless because in most cases we hardly stick to it because life happens. Indeed, life happens.

It also occurred to me that while every personal finance blogger tells people to have a budget very few actually do something like budgeting 101 or budgeting for dummies to give the average person like me a real sense of how budgeting works or should be done. In this post, I attempt to do just that.

What is a monthly household budget?

I was raised by a trader. My mom crossed the border between Zimbabwe and South Africa, Botswana, Zambia and occasionally Mozambique selling different crafts from Zimbabwe. In fact, I was once nearly stolen on the train when she took me to South Africa as a baby. I bring this up because most people in my life have been employed informally. Back when the Zimbabwean economy worked traders could plan their lives send kids (me) to good schools, live middle-class lives and pay their bills. All over the world, the middle class is feeling a little bit of a pinch. The cost of essential commodities is rising faster than people’s salaries, and this makes it a little bit harder to plan for the immediate future, and the long term is often left out of the equation.

Your monthly budget is a plan or a road map for your finances.

Step 1. (HOW MUCH MONEY DO I HAVE)

Be honest with yourself in terms of your income. How much money do you earn per month? If you have a regular job how much are you taking home after the government takes its share and all your other deductions? If you are self-employed, you may want to calculate an average from the last 6 months. Or as my mother would do – make a budget based on your two lowest earnings over the previous 6 months. Unless you have a fancy high paying job in the tech industry your monthly paycheck will likely stay the same for at least a year – the economy – right!

Step 2. (WISH LIST)

What are the things that you need to live from month to month? Primary needs vary from person to person, but generally, these include (not necessarily in this order):

| Household Expenses |

| Mortgage/Rent |

| Car loan |

| Car insurance |

| House insurance |

| Life insurance |

| Childcare |

| Parental Care |

| Remittances if different from PC |

| Charitable giving and tithing |

| Gas/electricity |

| Telephone |

| Cable |

| Internet |

| Food |

| Gas/electricity |

| Pet supplies |

| Healthcare |

| Entertainment |

| Gifts |

| Clothing |

| Security |

| Tuition (it helps to divide the annual cost by 12) |

| Travel (this is a HUGE cost in our house) |

| Other |

The best way to figure out how much you spend is to go over your past bills. Try to be as honest with yourself as you can.

I always try to start off the year with a budget breakdown. I am changing jobs, so this is a perfect time to redo the budget and think over my finances. This is a rough draft and a lot more complicated because we do not know for sure yet what our final income will look like and the actual expenses, but this should give you a general idea of how we are thinking about things. I also call this my dump it in all list. We start out by listing all the major expenses (after tax) then we will adjust as we go forward. We are trying to budget about 80% of our combined income – we assume that the real costs will be higher so we will adjust the income portion accordingly. The income from my businesses is pretty set, so there is no wiggle room there.

Step 3: DO THE MATH

Plug in the numbers – before you worry about what financial experts say about proportionality just go ahead and do the math to see where you are. Especially on your basic needs. Doing this will help you readjust as needed for long term planning. Your budget can be very fancy, but I like to keep mine simple. This is an easy to use template from mint.com

| Monthly Budget Template |

|

|

|

|

| Monthly income for the month of: _January 2020___________ |

|

|

|

| Item |

Amount |

proportion |

| Salary |

1000 |

|

| Spouse’s salary |

1000 |

|

| Dividends |

|

|

| Interest |

|

|

| Investments |

|

|

| Reimbursements |

|

|

| Other |

0 |

|

| Total |

2000 |

|

|

|

|

|

|

|

| Monthly expenses for the month of: ___________ |

|

|

|

| Item |

Amount |

|

| Mortgage/Rent |

400 |

20% |

| Car loan |

|

|

| Car insurance |

|

|

| House insurance |

|

|

| Life insurance |

|

|

| Childcare |

|

|

| Charity |

|

|

| Gas/electricity |

|

|

| Telephone |

|

|

| Cable |

|

|

| Internet |

|

|

| Food |

200 |

10% |

| Gas/electricity |

|

|

| Pet supplies |

|

|

| Healthcare |

|

|

| Entertainment |

|

|

| Gifts |

|

|

| Clothing |

|

|

| Other |

0 |

|

| Total |

600 |

|

|

|

|

|

|

|

| Income vs. Expenses |

|

|

|

|

|

| Item |

Amount |

|

| Monthly income |

2000 |

|

| Monthly expenses |

600 |

|

| Difference |

1400 |

|

The first time you do this, you may find out that your actual budget is more than 120% of your income. I have done this too- but I find that the visualization really helps.

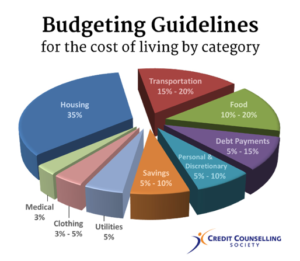

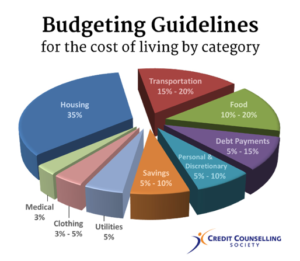

Ideally, you want to balance out your budget so that you are spending between 30 &35% of your gross income (pretax) on housing, 15-20% on transportation, 20-20% on food and less than 15% of your income should be going to debt. It is also recommended that you save at least 5% of your income but if you can save 20% including retirement and health care contributions that will be really good. But remember, aggressively saving should only happen when you have paid off your debt.

Here is an example of our budget for the next phase of our lives. I prefer using excel and color coding the budget.

| MONTHLY INCOME EXPENDITURES |

| Account |

Proportion post-tax (net) income of 80% net of both spouses |

Proportion of pre-tax (gross) income |

| household Fixed |

|

|

| Rent |

31% |

23% |

| Cellphone Bill |

1% |

1% |

| car payment (60-month finance) |

6% |

4% |

| Health care (co-payments, Yoga and Biking) |

3% |

2% |

| parental care (child care for others) |

15% |

11% |

| Monthly Groceries |

6% |

4% |

| car and renters insurance |

2% |

2% |

| Utilities (electricity and water) |

1% |

1% |

| PRE-TAX CONTRIBUTIONS |

|

|

| health insurance (pre-tax) |

|

6% |

| dental (PRE-TAX) |

|

1% |

| vision (PRE-TAX) |

|

0% |

| Uncle Sam |

|

15% |

| Retirement contributions 403 or 401k (PRE-TAX) |

|

6% |

| POST-TAX SAVINGS |

|

|

| Amex Savings (long- and short-term goals minus EF) |

16% |

12% |

| Acorns Roth plus tiaa Roth (investment for dummies) |

3% |

2% |

| Emergency fund monthly contributions |

2% |

1% |

| MEH ESSENTIALS |

|

|

| cable and internet |

1% |

1% |

| Car fuel (transportation) |

1% |

1% |

| charitable giving |

1% |

1% |

| Eating out and entertainment |

1% |

1% |

| Clothes and other fun shopping |

1% |

1% |

| Travel (non-reimbursable) |

1% |

1% |

| Laundry |

0% |

0% |

| FAMILY SUPPORT |

|

|

| Remittances- tuition for niece and nephew |

1% |

1% |

| Remittances family 1 |

1% |

1% |

| Remittances Family 2 |

1% |

1% |

| FAMILY FUND (contributions for funerals, health, weddings, etc.) |

1% |

1% |

| Debt free 🙂 |

0% |

0% |

|

|

100% |

| TOTAL MONTHLY EXPENSES as a proportion of net and gross |

98% |

68% |

| Source |

Percentage of post-tax income |

|

| BOA standing |

|

|

| Account left over from month to month. |

|

|

| Spouse 1 salary after significant deductions (health care) |

61% |

|

| Spouse 2 portion of salary after deductions (only 33% of income) |

33% |

|

| business 1 income |

4% |

|

| business 2 income |

2% |

|

| Note: this is based on just 83% of our combined income. We are hoping to adjust our expenses to live on only one income in the future. Our actual tax bill to Uncle Sam is 21% this is lower because of some minor adjustments we are working on. We also recently discovered that we underbudgeted travel last year so we will need to clean that up. We are paying more on our car note to try and pay it off sooner -the actual bill is just 3% of our gross income. Although we have met our emergency fund goals, we want to keep growing it with hopes of increasing our family fund contributions as well as our charitable giving. |

Just adding the colorful version here because it is so pretty

Step 4. TEAMWORK

Clean up the budget. If you have a partner the assumption here is that you are working together or as is the case in most unions one person will build the budget skeleton, then the team will sit down to clean it up and adjust numbers. I will also write an entire post on how to have the money talk with your spouse and partner. If you are living in a volatile economy, try very hard to plan with inflation in mind or change some of your money to a more stable currency to give you some peace of mind. If this is not possible, please share some tips and strategies, you have used to stay on track.

Step 5. CASH ONLY

Avoid using your credit card or loans to fill in the gaps. Access to credit can create a false sense of stability. Most financial gurus advise against using credit cards for this very reason. Use cash (checking account, mobile money, etc.) as much you can.

If you do use your credit card, schedule auto payments for the beginning of each month. I like to use credit because I get points, but I am also vigilant about paying off expenses each month. Credit cards are a trap that you should really try to avoid.

Do not budget with someone else in mind- for example, some will say Uncle X always sends money. This is a bad habit. Unless you have some reason to believe that uncle X will show up, do not burden someone else.

Step 6. NO MONEY FOR FUNSIES -JUST KIDDING- NO SERIOUSLY, NO MONEY FOR FUNSIES

Cut out non-essentials and live maybe 10-20%below your means. If you cannot afford to pay cash for something, then you do not need it. If an expenditure is causing you sleepless nights, ask yourself if it is worth the stress and increase in your health care costs. If you cannot afford your car or house or house help service, you DO NOT NEED IT! If your kid’s tuition is a constant conversation in the family group, then you are probably sending your kid to a school that is out of your $ range.

Step 7: STICK TO THE BUDGET

Stick to the budget – I will devote a lot of time in the blog discussing some strategies for sticking to the budget drawing on my personal failures and successes. Please share your tips as well. I want to learn from you.

ADVANTAGES OF making A BUDGET and sticking to it

You are probably asking yourself – why bother? I think about my financial health as being closely tied to mental and physical health. If you sometimes stay up late crunching numbers, then you want to do this so that you can sleep better, but we can also just list out the reasons here

- Know what you need to be happy – this is great for negotiating your salary. After I finished my doctorate, I was offered a consulting job at a big firm. I was super excited and too scared to negotiate, so I accepted the first salary they gave me. The salary looked great on paper, but I was not going to be able to live in expensive Washington DC on those numbers. Now, when I get a job offer, I always try to negotiate for a salary at least 20-30% above my needs or current salary. Moving is expensive, and it is often the case that the cities with great jobs tend to cost a lot more

- REDUCE EMERGENCIES-I really believe that there are very few real emergencies. Everything else can be planned for. Your car breaking down should not make you bankrupt because ideally, you have an emergency fund to pull from. Child Care should not give you sleepless nights because while pregnancy can be a surprise, the arrival of the baby is not. Include health care costs in your budget early on. Having conversations with mom and dad about their health care will also reduce “emergencies” in the future. Funerals can be an emergency, but weddings are really not the same as children’s tuition, graduation, baby showers, and birthday parties.

- Saying NO- It is a lot easier to say no to unwelcome money requests when your money is budgeted for. In future posts, we will discuss long and short-term financial planning. It is a lot harder to say no to people we love when we have what I call idle – unaccountedfor money.

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Mar 22, 2018 | Uncategorized

Flake, Coons Outline Framework for U.S. – Zimbabwe Relations

Posted on Mar 22 2018

WASHINGTON – U.S. Sens. Jeff Flake (R-Ariz.) and Chris Coons (D-Del.), both members of the Senate Foreign Relations Committee, today introduced a bill to lay the framework for U.S. relations with the new government in Zimbabwe. This legislation updates the Zimbabwe Democracy and Economic Recovery Act of 2001 and sets forth the steps Zimbabwe needs to take to have sanctions on its country lifted.

“President Mnangagwa has signaled his intent to bring about change in Zimbabwe. His words need to be followed by concrete actions,” said Flake. “This measure outlines steps that, if taken, would go a long way to demonstrate that President Mnangagwa is earnest in his desire to bring about long-overdue change for the people of Zimbabwe, who suffered under authoritarian rule for far too long.”

“After 37 years of suffering under the repressive rule of Robert Mugabe, the people of Zimbabwe should be excited about the possibility of a brighter future. To ensure conditions throughout the country improve, the international community should insist on concrete actions from the new government of Zimbabwe before lifting sanctions and renewing investment in the country. This bill is intended to outline the U.S. Senate’s expectations of the steps President Mnangagwa and other leaders should take,” said Coons. “We look forward to visiting Zimbabwe, meeting with its top officials, and assessing the steps they are taking to hold free, fair, and credible elections as well as to advance broader economic and political reforms to improve the lives of all the citizens of Zimbabwe.”

To view a PDF of the bill, click here.

Summary of the Bill and conditions for lifting sanctions:

‘‘(2) PRE-ELECTION CONDITIONS. —The following pre-election conditions are met:

‘‘(A) Establishment and public release, without cost, in both paper and digital formats, of a biometric voter registration roll that is endorsed by all registered political parties.

‘‘(B) An independent electoral management body is selected, the members of which should be nominated by all political parties represented in the parliament of Zimbabwe, and permitted to entirely carry out the functions as- signed to it in section 239 of Zimbabwe’s 2013 constitution in an entirely independent manner.

‘‘(C) The Defense Forces of Zimbabwe are neither permitted to actively participate in campaigning for any candidate nor to intimidate voters, and must verifiably and credibly uphold their constitutionally mandated duty to respect the fundamental rights and freedoms of all per- sons and be non-partisan in character.

‘‘(D) International observers, including from the United States, the African Union, the Southern African Development Community, and the European Union are permitted to observe the entire electoral process, both prior to, on, and following voting day, including by monitoring polling stations and counting centers, and are able to independently operate in a manner enabling them to access and analyze vote tallying, tabulation, and the transmission and content of voting results.

(E) Candidates are allowed free and full access to state media, which must afford equal time and coverage to all registered parties, in an impartial manner, and must be able to campaign in an environment that is free from intimidation and violence.

‘‘(F) Civil society organizations must freely and independently be able to carry out voter and civic education, and to monitor the entire electoral process, including by observing, recording, and transmitting public-posted or announced voting results, including at the ward, constituency, and all higher levels of the vote tallying process, including through the conduct of one or more parallel vote tabulation exercises.’’;

(2) by redesignating paragraphs (3) and (5) as paragraphs (7) and (8), respectively;(3) by striking paragraph (4); (4) by inserting after paragraph (2) the following new paragraphs:

‘‘(3) PRESIDENTIAL ELECTION. —Zimbabwe has held an election that is widely accepted as free, fair, and credible by independent international and domestic civil society monitors, and the president-elect is free to assume the duties of the office.

(4) UPDATING STATUTES. —Laws enacted prior to passage of Zimbabwe’s new Constitution in March 2013 that are inconsistent with the new Constitution are amended or repealed so that they are consistent with the Constitution.

‘‘(5) UPHOLDING THE CONSTITUTION. —The Secretary of State has certified that all elements of the Constitution, including devolution, are being implemented.

‘‘(6) ECONOMIC REFORMS. —The Government of Zimbabwe has demonstrated a sustained commitment to reforming Zimbabwe’s economy in ways that

will promote economic growth, address unemploy- ment and underdevelopment, and restore livelihoods. ‘‘(7) DIAMOND REVENUES.—The Secretary of State has certified that a transparent and credible accounting for all diamond revenues since 2000 has

taken place.’’; and

(5) in paragraph (7), as redesignated by para-

graph (2) of this subsection, by striking ‘‘consistent with’’ and all that follows through ‘‘September 1998’’.

SEC. 7. REMOVAL OF AUTHORITY TO PAY LAND ACQUISI- TION COSTS.

Section 5(a)(2) of the Zimbabwe Democracy and Economic Recovery Act of 2001 is amended by striking ‘‘, including the payment of costs’’ and all that follows through ‘‘thereto’’.

SEC. 8. INCLUSION OF AUSTRALIA IN CONSULTATIONS

ABOUT ZIMBABWE.

Section 6 of the Zimbabwe Democracy and Economic Recovery Act of 2001 is amended by inserting ‘‘Australia, and the United Kingdom’’ after ‘‘Canada,’’.

SEC. 9. SENSE OF CONGRESS ON PAST ATROCITIES AND

HUMAN RIGHTS ABUSES.

It is the sense of Congress that the Government of Zimbabwe should take immediate action to—

(1) unify the people of Zimbabwe by—

(A) acknowledging that human rights have been abused, including during the urban land clearances of Operation Murambatsvina, and the violence perpetrated in the wake of the 2008 election against the opposition and citizens of Zimbabwe;

(B) undertaking a genuine process of national reconciliation up to and including acknowledging and apologizing for atrocities in Matabeleland (Gukurahundi); and

(C) taking steps to offer redress or compensation to victims of abuses identified in sub- paragraphs (A) and (B), in a manner recommended by the Zimbabwe Human Rights Commission and the National Peace and Reconciliation Commission; and

(2) order an immediate inquiry into the disappearance of prominent human rights activists, including Patrick Nabanyama, Itai Dzamara, and Paul Chizuze.

SEC. 10. SENSE OF CONGRESS ON ENFORCEMENT OF SADC TRIBUNAL RULINGS.

It is the sense of Congress that the Government of Zimbabwe and the Southern African Development Community (SADC) should enforce the SADC tribunal rulings from 2007 to 2010, including 18 disputes involving employment, commercial, and human rights cases sur- rounding dispossessed Zimbabwean commercial farmers and agricultural companies.

SEC. 11. SENSE OF CONGRESS ON STEPS THAT MIGHT IN- CREASE POSSIBILITY OF INCREASED TIES.

It is the sense of Congress that the United States Government would be more optimistic about the possibility for increased ties with Zimbabwe, including in the areas of trade and investment, if—

(1) the government of Zimbabwe takes the steps outlined in section 6 and takes concrete, tangible steps outlined in paragraphs (2) through (7) of section 4(d) of the Zimbabwe Democracy and Eco-nomic Recovery Act of 2001, as added by section 6 of this Act; and

(2) takes concrete, tangible steps towards—

(A) good governance, including respect for opposition, rule of law, and human rights; and (B) economic reforms such as respect for contracts and private property rights.

![Chipo Dendere Explains position on Sanctions.]()

Mar 2, 2018 | 2018, U.S. Congressional Hearing on Zimbabwe Feb 28, Zim Politics

Chipo Dendere Explains position on Sanctions

After my testimony at the U.S. House of Congress I have received mixed feedback, most of it good and constructive. Thank you. There is also a concern among others on my position regarding sanctions.

You can see the full list of individuals and institutions under sanctions here

It is important to reiterate that as a scholar I am well aware of the challenges with sanctions and I do not think that broad-based sanctions on poor countries like Zimbabwe are effective. In my written statement I wrote:

“In 2001, the United States Congress passed the Zimbabwe Democracy and Economic Recovery Act (ZIDERA),[1] commonly referred to as sanctions in Zimbabwe. Mugabe and his government blamed many of the countries’ economic woes on these sanctions. Debates on sanctions are complex, and there is a lot of academic evidence that suggests sanctions negatively affect the poorest and most vulnerable. At the same time, targeted sanctions also constrain the behavior of rogue politicians who would otherwise have free access to resources (world class universities, shopping, properties, functioning banks) around the world while denying their own citizens the same opportunities.”

In the Zimbabwean case I recommended that the United States reconsider removing sanctions on state owned enterprises. I wrote:

“With regards to individuals and government institutions under the targeted sanctions list, the post-Mugabe era provides new opportunities for engagement between Zimbabwe and the United States. I recommend that the United States reconsider sanctions on state owned businesses. I recognize that the United States has long been concerned with the link between ZANU PF and state enterprises. Indeed, much of the corruption I discussed earlier has occurred in state owned businesses. However, it is my expert opinion that in the post-Mugabe era parliament has been bolstered in their independence and are better equipped hold government officials to account. I would like to draw attention to those parastatals engaged in agriculture and mining industries. Most small holder farmers depend heavily on funding from the state funded agriculture bank which in turn depends on support from big financial institutions.

State owned and other enterprises under targeted sanctions include (according to the State Department- some of these companies are no longer in business but remain on the list):

AGRIBANK

INDUSTRIAL DEVELOPMENT CORPORATION OF ZIMBABWE LTD INFRASTRUCTURE DEVELOPMENT BANK OF ZIMBABWE MINERALS MARKETING CORPORATION OF ZIMBABWE

ZB FINANCIAL HOLDINGS LIMITED

INTERMARKET HOLDINGS LIMITED

SCOTFIN LIMITED

ZIMBABWE IRON AND STEEL COMPANY

ZIMBABWE MINING DEVELOPMENT CORPORATION

ZIMRE HOLDINGS LIMITED

OSLEG (PVT) LTD

ORYX DIAMONDS (PTY) LTD

ZIMBABWE DEFENCE INDUSTRIES (PVT) LTD”

I also suggested that the United States provide clarity on the types of business to business engagements acceptable within the confines of ZIDERA. It is important that our small businesses have a fair chance of getting access to credit. If we strengthen the private sector we will grow a stronger middle class and this is very good for democracy and our ability to pull our people out of poverty. I also asked that the United States support efforts by Zimbabweans asking for debt relief from international funding agencies including the World Bank and IMF. Such efforts will bring much needed relief to millions of Zimbabweans, especially farmers, who could increase food production if they have access to credit. Extending credit to startups can allow business owners like Simbarashe Mhuriro, 32, founder and Managing Director a renewable energy development company to employ more people thereby providing sustainable solutions to poverty.

Zimbabwe does not have a shortage of bright ideas that can get our country moving forward. Consider this- the founders of Uber were inspired by the Zimbabwean experience. The idea of a billion-dollar industry came from Zimbabwe – imagine that. How many Zimbabweans with great ideas do you know? My aunt was gifted a beautiful piece of cloth for her daughters roora. The material was then shipped to the U.S. for her to have a dress made. She was not aware that she would have to spend $250 on a tailor-made dress. She wanted to honor her son in law and so begrudgingly she parted with this money. She looks great. I know that her younger sister who was once a seamstress for Adams – that uniform company would have been able to make the same dress for cheaper. If our manufacturing was back up to standard we would be exporting beautiful dresses, we have the cotton, we have the resolve and more importantly we have the ideas. Our main limitation is access to credit. I think most of us agree on this.

The problematic part of the statement:

Sanctions that target individuals. I believe this is what has upset most people. I said:

“With regards to sanctions that target particular individuals the onus is on those listed to prove to Zimbabweans and the global community that they are now committed to democracy. The majority of those listed have committed horrible crimes against their fellow citizens and it would be a bigger injustice to those harmed to remove them from the sanctions list before a thorough investigation has been conducted. Zimbabwe cannot have economic growth that is divorced from addressing human rights challenges. Robert Mugabe’s exit from politics is not enough to absolve individuals from crimes.”

In preparing this statement I spent a lot of time looking over the list of individuals under sanctions. Many of them are government officials, many of them are individuals that most Zimbabweans fear or continued to fear until recently. The question for most people is this- how can our government engage if our officials cannot travel. Let me answer this in a few ways

- What kind of travel restrictions do those listed face?

- They CAN travel for business. Ambassador Ray clarified this. If our minister of foreign affairs had a meeting at the World Bank they might have to fill out some additional paper work but they can attend that meeting. I know with absolute certainty that the people at the World Bank are excited and happy to engage with Zimbabwe and most are itching to approve development programs in Zimbabwe

We have many talented people within the government who can represent us at various events who are not listed on sanctions. Many. In fact, in the past when organizations have asked for Zimbabwean reps to attend meetings abroad it was our government that denied them permission to travel.

- They CAN NOT travel for leisure to the United States.

- Why are they under sanctions?

It was explained to me that those under sanctions have done one or more of the following.

- Crimes against fellow citizens

- Abuse of power

- Violation of Human rights

- Serious corruption that has cost the country millions of dollars

I do not know if they are guilty or innocent but I do know for sure that as violence escalated in the period after 2000 their names were associated with some of that violence. As I looked over the names I found it curious that some people whom I did not think had been active politically were listed like spouses of politicians – let’s call her Tendai. A simple google search reminded me that back in 2007 she assaulted Morgan Tsvangirai terribly, in addition to physical abuse she called him a dog and had many choice words for MDC activists. She never apologized nor did she face justice. May I kindly suggest this article for your reading http://allafrica.com/stories/200708020781.html. I think we would be remise to advocate for people who have not yet advocated for the weak, the vulnerable and those who have suffered great injustice. I do not think that their inability to go and shop abroad is in anyway an injustice to Zimbabwean development.

I believe that everyone is redeemable. I just think that those who have caused Zimbabweans great pain should apologize to Zimbabweans, to millions who were violently displaced during Murambatsvina, to black farm workers who suddenly found themselves without an income and in more extreme cases a home, to the people who lost limbs and loved ones after the 2008 elections.

[1] Wiliam Bill Frist, Zimbabwe Democracy and Economic Recovery Act (ZIDERA).

Targeted Sanctions list

Discussion