May 6, 2019 | Money Professor

RETIREMENT IS COMING

SOURCE: GETTY IMAGES

ARE you thinking about retirement? I know it sounds crazy if you are in college, in your 20s or like me in my early 30s. But no matter where you are on this journey you should be thinking about it. If you are in your 40s, 50s or 60s maybe retirement feels a little close, and you are feeling worried. Worry not – as long as you start planning today then you are not late or too early. Depending on where you are- your strategies will be different.

TARGETED AUDIENCE: Everyone with a special focus on the immigrant professional. You probably asked yourself-what the heck is a 401k anyway?

NOTE: This post is about regular retirement goals (after 60). I love the FIRE movement (Financial Independence Retire Early), but I am not sure that is for me. I have however learned a lot from the movement, and I encourage you to read as much as you can from them. FIRE folks aim to retire as early as 29 or 39. To meet those goals they live on less than 25% of their income and make so many sacrifices.

SO HOW DO I GET STARTED?

Bonus disclaimer: To prepare for this post I had two phone calls with financial advisors from our retirement management fund- you can call anytime and its free (double check to be sure), I also spoke to my bank then two financial advisor friends who donated their time. The advice was pretty consistent across the board which made me feel confident to write this blog. I have also been reading a ton of books, blogs and I LOVE reddit. However, there is a lot I do not yet know so please correct me and share knowledge from your experience.

How much do you need to retire? It depends on your current budget– you will need about 85% of your current income in retirement. Some advisors say this amount may even be too little because retirement lifestyle can be expensive. Enjoying retirement might include traveling more (without company reimbursement), and I don’t know about you, but when I am home, I eat more and shop more. At the same time, you may already be living a debt free life – No mortgage and no debt! PAY OFF THAT DEBT! BUT our kids might need more financial help, so there is that –

BEFORE we get bogged down with numbers, let’s think about the different ways available to us to save for retirement. Younger readers- I wish I had started saving in college or early 20s. You are at the best stage to start saving. I promise 🙂

Dave Ramsey, Nerd Wallet and a whole bunch of other money smart people say you should put at least 3% of your income towards retirement. However, 15% is better – but since many of us are still starting just putting something is good. My very first full-time job did not offer me an employer match or contribution so after doing my budget and looking at my debt I could only contribute $100 each paycheck. I worked that job for two years; the employer fund had great returns. I recently checked the account in preparation for this blog and my very small contribution has grown to $6,000. Just this quarter alone I made gains of $745 – YAY! I anticipate some losses in the next few years, but I am sure it will bounce back.

SAVING FOR RETIREMENT WITH EMPLOYER-SPONSORED (pre & post-tax) PLAN 401/403/IRA

- 401 (k) or 403(b) This is a pre-tax invest plan offered but employers. Breaking it down:

- Safe harbor Some employers put in money into your account whether or not you make any contributions. This is called a safe harbor contribution. These are rare but quite common in higher education. Yay to academia. The various schools I have worked for have each offered anywhere between 3 percent and 9 percent just because I worked there.

So, let us say Chipo earns $50 000/year and my employer safe harbor is 3% – each year her employer will put in $15 000 annually into her retirement plan. This is an additional benefit to your salary.

If Chipo does not add anything else according to this 401(k) calculator, she will have $232k for retirement at the age of 67 with a 6% rate of return.

- Employer Match: A more common plan is one in which the employer says if you put in at least 3% of your income, we will also put in 3% this would be a 100% match. Nice. So, you put in 3% and get 3% in free money- a lot of young people lose out on this benefit because they do not put in the minimum required to get the match. Others say they will match up to 3% so if you only put in 1%, they will put in 1% if it is a 100% match.

Back to Chipo with $50 000

3% self-contribution will be $1500/year

3% employer match $1500

Assuming a 6% rate of return starting at the age of 33 with $0 savings so far, she will have $445k in retirement. By putting in just 3% of her income, she has doubled her retirement funds.

- My fav situation is when you have both the safe harbor and the match. The lingo is a bit complicated- you can read more here. At a few universities, the contributions look like this

Your employer will invest safe harbor 3% regardless of what you put in

Your employer will then match up to 3% of your investment

You will put in 3% into your fund

Nice! Under this plan, you will get 9% invested towards retirement.

Assuming a 6% rate of return starting at the age of 33 with $0 savings so far, she will have $697k in retirement. This is the BEST!

Benefits of a 401(k) fund

- Tax benefits: If you max your pre-tax contributions to the allowed amount for 2019 which is $19 000 for those under 50 and an additional $6,000 for those over 50.

You will only be taxed on (annual income-tax contribution). This includes an employer contribution.

- You will have to pay taxes after retirement – this is when a ROTH 401(k) might look a bit more attractive.

- How do I know what plan is best? Let your budget inform you. There are seasons when you want to reduce your tax bill by contributing more.

- Shelter from creditors- Most plans offer creditor protection.

- Employer matches and contributions – discussed above. Most employers do not contribute to post-tax contributions.

- Secret: You can withdraw for certain things with no fines. For example, you can withdraw money towards your first home payment up to $50k and for a medical bill. I am excited about this option (my financial advisors were too). Most of us do not have access to family loans for that first house or substantial medical bill, and this is a nice option to have. You will pay yourself back with interest, and you may lose out on returns during the time the money is out, but you can also avoid ridiculous interest rates. It could be a win-win with the right kind of research and planning. -plans differ on this so please do a double check.

Downsides of a 401(k) fund

- Taxed at withdrawal – you could be in a higher income tax bracket at retirement

- You can only start withdrawing at age 59.5.

- Fines for early withdrawal for unspecified reasons.

- Some plans have high fees. Do check with your retirement plan about the associated costs. I received a tutorial from TIAA to understand my fees, and so far I am happy with what they offer. Almost every fund has fees so you should not let this derail you too much.

A Roth 401(k)

With the Roth 401(k) you get can still contribute the same max of $19,000 but after tax. This means that when you withdraw your money in retirement, you will not owe taxes (except on the interest). This is a good option if you are in a position to pay a higher tax bill- probably great for younger folks who may have lower responsibilities early on in their career.

HSA – HEALTH SAVINGS PLANS

SOURCE: GETTY IMAGE

This is a little-known secret. It is a great tax-free way to save for future health expenses during your healthier years. Your employer offers you two or three health care plans. One has low monthly payments and higher out of pocket (HIGH DEDUCTABLE). There is usually a max for what you pay out of pocket with either plan so you will not be entirely stranded. This plan allows you to add $3, 500 for an individual and $7, 000 for out of pocket costs. Some employers will also contribute to this plan – some make a 50% contribution which is very nice. The money will grow with interest. You only need to use the funds for health care expenses, and they roll over from year to year.

Your plan will give you a list of what is approved.

I set aside $500 for our family of two the first time I played around with this. I have been able to pay for co-pays, acupuncture herbal tea, some cold medication. I have a debit card linked to the account. If the purchase is not approved, it makes a huge BING sound lol.

Keep your receipts. You can ALWAYS submit for reimbursement.

Other things with health care: Check if your plan covers things like a gym membership, yoga- you can tell I love yoga. I go every day for two hours when I can. The costs can add up quickly.

POST-TAX CONTRIBUTIONS

401(K)

Same as pre-tax but after you have paid your tax bill. For 401 the max is still $19,000. This is an option if your employer does not offer after tax.

Roth IRA

In contrast, Roth IRA contributions are made with after-tax dollars. That is, they don’t reduce the amount of your gross income, or your tax bill, the year you make them. The tax benefit you get comes at retirement, when you don’t owe any income tax on the money you withdraw from your Roth IRA—because you already effectively paid it, back when you contributed.

If you withdraw after the age of 59.5, then there are no fees associated with the withdrawal or penalty. This means you get access to your money a whole decade earlier than with traditional 401k.

Summary

PRE-TAX – You reduce your annual tax bill by however much you put into the pre-tax plans. You will pay tax in retirement.

401(K) elective deferral plans – you can put in up to $19,000 for 2019.

HSA- If you have a high deductible health plan you can put in $3,500 for an individual and $7,000 for a family

POST-TAX

IRA: this is the more popular plan-you can contribute up to $6,000 per year

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

May 3, 2019 | Money Professor

Today’s post was unplanned. I was thinking of finishing up a series on remittances and black tax but something a friend said has been nagging me. I had written to ask if White Zimbabweans/Africans also deal with black tax. In her response, she shared that she and her siblings were starting to discuss post-retirement help for their aging parents and grandparents. Like most parents in Zimbabwe, they too have lost their retirement and their pension is no longer worth much. My friend shared that her parents were able to assist her and her siblings through college allowing her to graduate without any college debt.

Caring for parents is not black tax

While my mom did not pay for my college, she did invest a lot in my early education. I believe this set me up to get full scholarships for college which also allowed me to graduate without debt. My parents in law also did the same for their 5 boys. Perhaps it is that I will be spending a bit of time with my mom in the next few weeks or that I am seeing that my young girl is no longer so young and I would love to see her work less, travel more, do more fun things and relax. My mother as I have mentioned many times was a trader and has worked really hard her whole life. In fact, this month marks the first time that mom has been able to take a week off from work. Imagine that!

I am sure you have many feelings about your parents as well and perhaps like me you are also beginning to think of how you can support them towards retirement. I have been asking myself how I can financially include care for my mother in my financial planning. I am lucky that my mother lives in a country with some type of pension fund for the elderly, but that amount is very little. My mom and I have many open money conversations, so I feel confident knowing what she needs on a monthly basis.

The list of the ten best countries to live for the elderly does not include any African countries.

So, for those of us with parents on the continent or other places with less secure pension funds we will need to start planning earlier in order to be able to support our parents. We really want to be in a place where we can provide care with a lot of love and very little strain. Most parents are also a little reluctant to discuss these issues because talking about money is hard and it is probably harder if we feel like the people, we love and cared for think we have become a burden. So, do be gentle and kind, in your thoughts and in the conversation when you are ready to have it.

What are some things to think about as we plan to care for our parents?

- Food, utilities and other everyday expenses: Do your parents have enough finances to cover everyday finances? How much is their budget for food and utilities?

- Health Care: If your parents do not have health insurance through work or the state you want to make sure that you get on this ASAP

- Do they have any prescription medications that they need regularly? What is the cost for that? Is this something that they can afford without your help if not, have you included their care in your monthly budget?

- Those of us with parents who insist on working will need to very vigilant here. Our health care plan for mom in law includes good orthopedic shoes because she refuses to REST!!!!

- Life Policy/Insurance: You want to make sure that you have some life coverage policy that includes your parents if they do not already have one.

- Mortgage/living arrangements:

- Is their home paid off? If not, what is the monthly mortgage/rent payment is this something that they can afford without getting into debt or will you need to assist them?

- A dear friend dealing with this told me that it is really important not to abruptly move parents simply because we think place B will be cheaper. As people get older their community is really important, friends and a shared history go a long way in keeping a healthy mind and healthy heart. When I had this conversation with my mom, I realized the importance of her being near her church, volunteer centers, small jobs and friends. Mom’s weekly lunches with friends and singing in the choir keep her calendar somewhat full and this is critical.

- Do you need to make any modifications to their home? When my dear late grandmother was getting on, we had to change the bathroom and bedroom furniture to accommodate a supportive bed and wheel chair. Even in the U.K. which has public health care, this is something we had to pay for. My grandmother in law whom I adore is no longer as fit as she once was. She still loves to hike up the little Masvingo hills to do her farming – this gives her much pleasure but strains her back- we have been investigating walkers that can get her up and down. If you have any suggestions send them my way – PLEASE – we love that she loves farming, but we love her more than the yummy goodies she harvests.

- DEBTS – You will want to know if they have any outstanding debts that have to be taken care off. It will be awful for the parents to lose their home over small amounts that you could have helped cover

- TRAVEL- Parents and seeing their grandkids is a whole mission. While my husband and I do not yet have kids, I have 9 nephews and nieces and my mother would like to see all of them. Obviously, those with children will need to cover the cost of travel for the parents – if this is you then you will have to decide how often you will want parents to travel or to go and see them and the associated costs. If your parents live with you, they may still want to travel to see the other kids or go on social trips. In our case, we have tried to budget for travel to the US for both sets of parents over the next few years. DO NOT FORGET TRAVEL INSURANCE!

- WILL & OTHER ESTATE PLANNING

- Do they have a will? This is not an easy conversation to have but it is important.

- Do they have an up-to-date durable power of attorney for finance?

- Do they have an up-to-date durable power of attorney for health care?

- Does their health care power of attorney contain a health-care directive that spells out their wishes for life-prolonging care?

Planning with siblings

If you have siblings, you may want to sit down as a team and discuss these issues. I know that this is not always possible because of family dynamics. In an ideal situation, you may want to divide the various responsibilities amongst yourselves.

LOVE FIRST

Remember that this conversation (even when you have it with yourself) must come from a place of love and thoughtfulness. Tell your parents that you love them as often as you can.

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

May 2, 2019 | Money Professor

MONEY CLUBS/ ROUND/ STOKVELS

I was not planning to write about money clubs/Stokvel at this juncture but a friend and fan of the blog asked me about them and I figured why not? I love money clubs, grocery clubs, building clubs, etc. They are a uniquely African solution to challenges faced by African women (I know women in other countries use them). I actually think under the right circumstances women all over the world should use them (and men too!).

Discussions about money clubs are often controversial and get very personal really quickly so I am going to focus on how you can decide if this is a good money decision for you. One of my favorite Facebook groups with over 40,000 Zimbabwean women often has some lovely & heated debates on the issue. More power to the ladies of PH and the admins who hold us all steady.

By focusing on how the clubs work I think we avoid value judgments about the system and instead strengthen good financial habits that can benefit us if we choose to join them or use other savings strategies.

What is a Money Club and How Does it Work?

Figure 1: How money clubs work

The idea behind money clubs is very simple. Members of a group come together and agree on an amount to contribute each month. A single member of the group receives the pooled funds on a monthly rotation.

Example: A Group has 6 members named 1-6

The cycle of the club runs for 6 months

Each member contributes $100 to the club for a total of $600

Each month one member is given $600 until the cycle is complete

Money clubs have a long history in most developing countries. My mom and almost all the women in our family have been part of a money club at some point. I benefited from a money club when planned our wedding – it was a lifesaver!

Saving is HARD!

I think of money clubs as savings training wheels. It is really hard to commit to setting aside 20% of your income because life happens. As women, we know this. If mom or mom in law needs something we often have to pull from our savings, if the baby needs something for school or if the church is doing a fundraiser, we often find ourselves pulling from our savings. If our money is in a money club then we can’t reach it, so we do not have to spend away from our savings on unplanned “emergencies”.

Sometimes Banks DO NOT WORK! Between the bank fees, poor interest rates and inflation sometimes banks are not an option. Women in Zimbabwe understand this all too well. So being a member of savings club forces us to put our money in a relatively safe option. The rate of default in most money clubs is actually quite low. I have followed over 100 clubs and only 3 have had major defaults. Banks should loan more money to women!

Before you join a money club- here are some things to consider

- Do you have a monthly budget?

- Being a part of a savings club does not eliminate the need for a budget. How else will you know what type of club works for you and how much you can afford to contribute per month

You can read more about making a budget on this post

- If you do not have a CLEAR budget, you may end up borrowing from other needs to cover your share of the contribution or you may end up defaulting which will be bad for the club

- Do you have CLEAR MONEY goals?

- I want to save is not enough because if you do not have clear goals when you receive that $600 windfall you will end up with idle money which now knows is not a good idea.

- You will need to have clear short- and long-term goals

- How much can I afford to lose and how much can I afford to be without

- Although default rates are low things do happen so you have to check your budget to determine how much money you can afford to lose

- Also, determine how much money you can afford to be without for the duration of the cycle – these two numbers determine the money club level that works for you.

e.g. if you earn $1,000 a month the most you can contribute to a money club is $200- the real number is likely less depending on how much you need for rent etc. My rule of thumb is that this should be 20% or less of your income. Even when you are in a money club you still need at least $500 for an emergency fund depending on your situation. A MONEY CLUB IS NOT AN EMERGENCY FUND

If you do not have a monthly budget and if you do not have CLEAR money goals, you are not ready for a money club J

Goal setting is a private conversation between you and yourself or with your partner. As with any other money issue please be honest with yourself.

Let us look at some good examples of money goals

- Goal – Pay or a Wedding or DOWRY ($5,000) due 12-month period

- This is a really good reason to join a money club. Most short-term interest rates are less than 3% (at least in the US & UK) and some accounts have high fees so, in this case, putting in a bank even when possible may be frustrating.

- Let’s say there are 5 people in the club each one contributing $500- the receivers will get $2,500 (including their contribution). Over a 12-month period, each person will receive twice

- As soon as you receive your payout make sure to settle at least one bill towards your end goal. Pay for the wedding dresses, pay for the cake, wedding venue – take care of other big-ticket items.

- Goal – buy a new stove ($1000 )due in 6 months

- This is not the type of goal where you can pre-pay unless there is a layaway option. In this case, I would join a club that paid out as close as possible to my goal. You want to avoid idle money

- Goal – pay expenses related to a kid going to the first year of high school ($1500) 12 months

- This is another great example of where you can make purchases towards the end goal as you go along

- Each time you receive a payout purchase school uniforms, notebooks, pay your tuition deposit and other related expenses

- Goal- pay for adult education ($2000) due in 12 months

- In this case, you may want to use payouts to pay tuition deposit, invest in school supplies or negotiate to move places so that you receive double the amount the month you have to pay tuition.

- Goal – Go home for a visit (estimated cost $3,000) in 18 months

- If you are in the diaspora – a money club could be a great way to make purchases towards your trip home. You can buy your ticket earlier and take advantage of cheaper rates. You can buy all the gifts you want to carry with you.

- Goal- Starting a small business ($500) in a year

- Money clubs are great for supporting your multiple streams of income initiatives. I have been reading that Somali expats in South Africa often pull money in this way to start up small businesses. In fact, when I asked around some of my girlfriends told me that they used funds from money clubs to fund their businesses and they have reinvested profits from the business to keep the club going. This is a HUGE win for small business.

- In my case, we used funds from our money club to help pay off debt and stock up. Eventually, we used our payout to give ourselves a bonus every 6 months.

- Goal- House down payment ($10,000) due in a year

- My favorite money club story is of 10 Zimbabwean women in Texas who used the money club to pay down deposits or outright purchase their homes. Each member of the group paid in $2000 a month for a total payout of $20,000. $20,000 was the perfect number for settling their down payments or paying off the mortgage.

Take away

So, my friend – if you are deciding whether or not a money club is right for you the answer is in your budget and your long/short term goals. Once I was done paying off my debt, I decided that I no longer needed a money club and shifted my focus to direct deposits in my savings account as well as maxing my retirement benefits. Our next major goals are scheduled for 3 years from now so if I were to join a money club, I would end up with idle money which is not good for me.

Please share with me stories about your experience with money clubs-THANK YOU!!!!

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

May 1, 2019 | Money Professor

I had about 30 tabs of financial blogs open on my computer when my husband asked me that question. Those of you who know him – know that he is so sweet and reserved and very thoughtful. I blabbered something about the budget then continued with my scrolling. However, over the months I have thought a great deal about why I wanted to write about money now.

I am not driven by having a huge bank balance for the sake of a huge balance, but I am interested in the freedom to love that money has given those around me. Financial freedom gives us time, access to good education and for some citizenship in places of their choice. Access to money can do good. I know – money and love in the same sentence – blasphemy!

When I was not well, I found myself surrounded by so much love and kindness and it has since occurred me that the financial cost of that love and kindness was not $0 on those who gave it. The night after my surgery I was unable to sleep. I was too scared to close my eyes. I thought if I did, I would never wake up. The thought of sleep as I watched my husband after 48 hours of caring for me finally find rest was attractive but also scary, so I stayed awake. One of my nurses came to sit with me from about 11 pm to 4 am. Over the course of the night, we shared personal stories about our lives. Then something she said struck a code in me. She had only just returned to work after having left to provide care for their baby. Financially they could not afford full-time childcare so she was working reduced hours. Since then I have read stories and spoken to health care providers who like many middle-class families can’t make ends meet. It felt unfair to me that someone who works so hard should struggle to care for their child. I felt really lucky that she had chosen to return to work and that I benefited from her care.

The following day one of my best friends came to the hospital and spent the entire day with us (We love you, Anna). That morning I also sent a text to our Pastor who was in our hospital room in what felt like minutes. I have shared this with people who responded with – well that is the job of a Pastor or friend. Perhaps, but churches do not run on water and neither do their cars. When we returned home our house was full of beautiful flowers. Our church family made a meal train and one of my very best college friends bought me the softest gentlest bedroom slippers (Thanks Kelz). There are too many people in our village who showed up for us- I will forever be grateful for your thoughtfulness. I understood the message my friends and church family were sending- they could not be there in person, but they were using their resources to let us know that we were loved and thought of.

Since then I have been able to go to yoga daily, see my therapist weekly and even get acupuncture. My acupuncture sessions were a gift from my Zim sisters who asked what they could do to help me. If I had let them, they would have flown the many miles to be in our home with me. I know that I have been able to physically heal faster because I have had access to resources that helped me do so.

A year or so ago I did something for my mother that cost quite a bit. The first thing her friend said to me was, Chipo your mother has never looked more relaxed and happier. There is no price tag for such joy or inner peace.

To me, money is a tool that we can use to improve our lives. Learning how to manage and navigate money issues is an important pathway to more wholesome and fuller lives.

I also like traveling. I won’t tell you how much we spent on flights because you will sooo judge me.

May 1, 2019 | Uncategorized

This should have been the first post, but it will likely not draw much traffic, so it is not the first post. When I received my first paycheck in college, I was so disappointed by how little I was making. I had worked for TEN HOURS! But the paycheck was so small. Who was this other person taking my money?

So little money

I was away from home and very new in America. I had no one to explain my first pay stub to be me. I am sure many of you have had this same confusion. In this very short post, I attempt to break down the pay stub. This will help make other things clearer as we move forward. Please forgive me – I am a teacher and tend to over-explain. Ignore what is not helpful. (But students do not ignore me in class- everything I say is IMPORTANT! LOL)

First job – yay

How much do I make? Whenever you signed your contract there was a number on there. The figure is likely what made you choose that job over others. Chipo has landed her first job after college and she will be making $60 000 a year. Chipo will likely divide that amount by 12 to get a ballpark monthly salary

$60 000/12 = $5 000

Chipo will be very happy with this number. She will assume that all her expenses will be met but she is WRONG.

What does a paycheck look like?

This is for the benefit of Generation Z who have probably never seen a physical paycheck. I also know that some of my millennial friends in Zimbabwe have never had a job and therefore they have never seen a paycheck either.

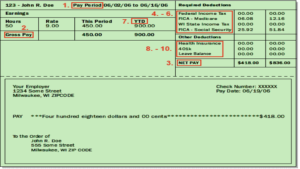

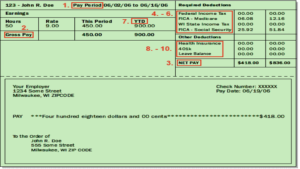

The image above is from the igrad their page has a lot of good financial resources.

- Pay period –

- this is the work period that you are being paid for. If you make an hourly wage you want to make sure that the dates are accurate. I make a fixed salary now, so I do not pay much attention to this.

- This is also important because some employers send out paychecks bi-weekly instead of monthly. You will need to know this to plan your savings strategy or for setting up your bill pay dates

2. Earnings

- Hourly rate – if you get paid hourly like John Doe here you will need to confirm that your hours have been inputted correctly.

- Over time – if you work more than 40 hours for 50-hour weeks then the additional 10 hours for that week will be paid at a higher rate of 1.5 your hourly rate.

- Gross pay

- This is your full earnings BEFORE any deductions in the example earlier this would be what Chipo calculated to be $5000 or $450 for John Doe

- Net Pay

- This is what you get to take home after the deductions

What is taken out before you get your actual paycheck

Required Deductions: Federal Tax, State Tax, Local Tax, FM TAX

You CAN not opt out of these deductions. Everyone has to pay for them. These are the monies that keep a country running and this also the reason that you should vote or engage in politics. From these standard deductions, your local and federal government pays employees, fixes roads, provides health care (or not) and education. The government can also loot and by themselves fancy cars at your expense. The explanation below is based on a U.S. system, but every country has something similar.

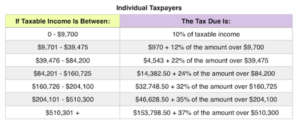

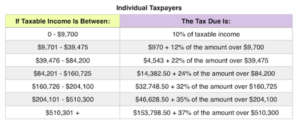

1. Federal Tax:

What you pay to the federal gov. There are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The bracket depends on taxable income and filing status, whether you are filling as a single person or as a married couple filing jointly. I am in the 21% tax bracket which hurts me inside a little.

2. State Tax

This varies from state to state. The 2019 tax rate for Massachusetts is 5.1 %. Just google your state and tax rate to find out your rate.

3. Local Tax:

This is rare but some localities have yet another tax. You may want to check this before you choose your next job- usually, it is not much.

4. FICA TAX

This is the federal Insurance Contributions Act, this is money taken out of your paycheck to fund programs like social security and Medicare. You really must pay attention to politics

5. MEDICARE-

There is a 1.45% tax on gross income for everyone to cover Medicare which goes towards health care for the elderly and disabled.

5. Social Security

This is the gov mandated retirement program. Everyone must pay in 6.25% of their gross income into the program. I just learned that you can check your social security benefits online. How many social security credits you have towards retirement or disability and benefits to your family in the event of death (so sad to think about). If you have been working in the US and paying social security then you have some benefits already. You need just 40 social security credits to benefit from the program. In 2019, you receive one credit for each $1,360 of earnings, up to the maximum of four credits per year. Generally, you need to have worked about 10 years to get social security benefits. It is a good idea to regularly log into your social security account online to check your benefits

The UK system is amazing -I just learned that after 65 everyone gets a nice pension. I am sure there are plenty of issues there too. South Africa may have something similar.

Voluntary-ish PRE-TAX DEDUCTIONS

Other deductions! I know it feels like it never ends – but the next set of deductions are a little more fun. They reduce your tax bill which is a nice bonus

- EMPLOYER-SPONSORED RETIREMENT 401/403 etc

More on this later – most companies offer various retirement options. Some offer a safe harbor contribution where you do not need to add anything in to get something. I just spoke to a friend who works for a university that REQUIRES all full-time people to put in 5% and they put in 9%. My university is wonderful. They will put in 9% whether or not I put in anything. They will also match up to 3% of my contributions which is great so each paycheck I have 15% going towards retirement which is really good.

2. MEDICAL FSA

This is a flexible spending health care plan. For example, this last year I set aside $500 for any co-pays (what you pay at the doctor’s office), I also use it for acupuncture (some policies allow), herbal tea, birth control (including condoms – seriously save tax on condoms). There is a lot you can do with it and in some cases, it rolls over. I also bought some sweet eyeglasses. Do you like my glasses? I need at least 2 pairs because every morning it is Tom and Jerry to find them.

3. HEALTH INSURANCE

Since Obamacare passed health insurance is now mandatory. Your employer puts in a portion and you do the same. More on this later but worth to mention that my husband and I found it cheaper to be on separate plans. I pay $118/month for my semi-comprehensive and my employer pays in $400. It is expensive but as I explained earlier it is worth it.

SOME ACRONYMS AND KEYWORDS

SM- MEDICARE

SS- SOCIAL SECURITY

FM – FEDERAL (M for Married and S for Single)

MA- Massachusetts for me so your State for you

DISCLAIMER: MoneyProfessor is my personal blog. I provide general information – not professional or financial advice. Opinions and representations on are my own. I am not providing financial advice or legal advice on my blog. I am only providing general information. You should consult a professional before making any financial or legal decisions.

Discussion